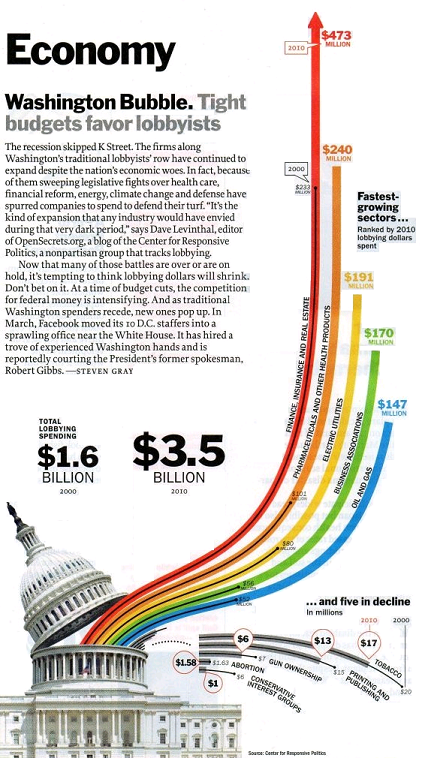

Ideally, you and I own Washington. After all, government is merely an entity that the private sector uses to further its own prosperity. It is not intended to be some sort of competing entity. Government is not to be run for its own benefit, but for the benefit of the people it was created to serve. And over the last 25 years Washington has become increasingly owned by one segment of the population – the FIRE industries. Barry Ritholtz posted this great image showing how the FIRE industry has been forced to pick up its game in trying times. After all, when your industry nearly craters the entire US economy it costs a lot more in lobbying efforts to buy back your friends in Washington. And that’s exactly what they’ve done:

Gauging from the rebound in bank profits, banker’s bonuses, bailouts and total lack of regulation in Dodd Frank, it’s fairly clear that the FIRE industry is still winning the lobbying game. This rather small segment of the US economy has now come to dominate Congress. And in doing so they directly undermined the goal of our representative republic. In the meantime, the rest of us all have to suffer through this continued environment that I like to refer to as cannibalistic capitalism. It is an environment where we prop up and focus on one specific sector of the economy with the misguided notion that this industry is somehow the engine of economic growth. The reality is that this industry takes much and produces little. They are eating the very engine that drives the economy when all they should be doing is greasing the pistons. Decades of flawed market theory have resulted in this obsession with monetary policy, the Federal Reserve and banking in general. And now as we sit with a private sector that is deeply indebted we continue to allow these industries to eat at the corpse we now call the US economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.