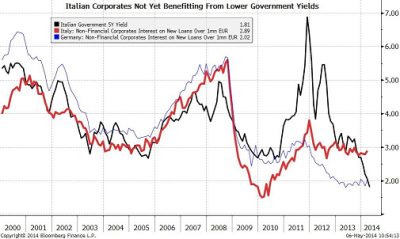

Important chart here from Michael McDonough at Bloomberg. It shows the spread between Italian sovereign bond yields and corporate bond yields. As you can see, as the government yield has fallen quite dramatically the corporate yield hasn’t followed.

This is not at all what the ECB would like to be seeing. This is one of the main reasons why the ECB is increasingly likely to implement QE. It’s also a key reason why QE in Europe might look very different than it does in the USA. In my opinion, the ECB is likely to focus on private securities markets in addition to the sovereign bonds. They really would love to see the yield reduction spill over into the private sector so they (hopefully) get some investment boost.

And of course, this means more chase for yield in the coming years as this is just one more set of instruments that are likely to get jammed lower….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.