There’s been a bit of a controversy brewing in recent days over the treasury market and why yields are so low. It all started earlier this week when Jeff Nielsen of Silver Gold Bull wrote:

“Previously, my own writing has focused upon one particular aspect of this absurdity: the highest prices for U.S. Treasuries at a time of maximum supply. This, in itself, is an absolute financial contradiction. The highest supply in history directly implies the lowest prices in history, for every market in the world — except U.S. Treasuries.”

His view is a conspiratorial one of the Treasury market that was then followed up by a series of different responses from Joe Weisenthal, John Carney and many others. This debate has been going on for years in some form or another (see my debunking of the “bond bubble” from several years for related thinking) so I’ll keep my opinion on this short and sweet since I think the current environment is a rather simple one to explain.

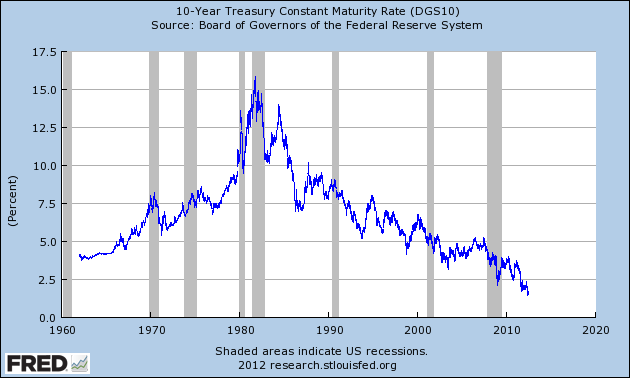

We can get into complex discussions about “safe assets” and “debt monetization”, but the simple fact of the matter is that demand for Treasury’s has been extremely high regardless of the supply. So bond prices are rising and yields are falling. But the more important dynamic here is the source of this demand. The Treasury market is really just an extension of Fed communications, which are an extension of economic strength/weakness. As I’ve previously noted, there’s a very high correlation between moves across the curve and the Fed’s actions. That is, the Fed controls 100% of the curve at the short-end and the market controls an increasing portion of the curve the further out we go. I often use the analogy of a dog on a leash. Bond traders are a lot like a dog on a 30 foot leash. And at the base the Fed controls 100% of the movement. But as we go further and further out the market controls more of the movement, but that doesn’t mean the Fed has no control of the long-end and in fact, if they wanted to, the Fed could theoretically control the entire curve. They’d just do the same thing at the 30 year bond that they do with the overnight market and they’d set the price verbally. Ie, Ben Bernanke writes a love letter to the bond market saying:

“Dear Bond Traders, we will be buying an unlimited amount of 30 year bonds at X%, and since we have unlimited ammunition to perform this task we hope you enjoy getting your faces smashed into the concrete if you should be so foolish as to take the other side of this bet. Thanks for playing, Ben.”

Of course, the Fed’s not doing that, but this doesn’t mean their communications are not highly effective. Bond traders aren’t an overly complex group of people. They don’t like to lose money because they get fired when they lose money. So keeping a close tab on Fed communiques is important in the bond market. The traders can run the leash out ahead of the owner and from side to side, but they don’t want to get too far away or they risk getting choked. So when the Fed repeats, on a monthly basis, that yields will be “exceptionally low through at least 2014” then the message is clear – “we think the economy is exceptionally weak and we expect to keep rates low for several years”. From a bond traders perspective that means one thing – yields aren’t going to surge because the economy will remain weak and even if the economy strengthens marginally the Fed has been very clear that they’re going to play it on the safe side and keep rates low for several more years. So, in a world of messy assets where foreign bonds look unattractive, real estate is in the dumper and equities appear exceedingly risky, this communication from the Fed makes the Treasury market appear like a relatively safe short-term place to invest. So demand is high thanks to this dynamic at work.

So, I don’t think we need conspiracies or asset shortages to understand what’s going on here. We just need to understand the thinking of a very influential entity forecasting a very clear message to the market that says:

“buy our bonds, we’ll make sure you don’t get your face smashed in any time soon!”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.