Noah Smith wrote a piece on Tuesday rejecting the idea that credit enables economic growth. His position can be summed up in the following quotes:

“If I borrow, I can get a nice big TV and a new car, but eventually I’ll have to skimp to pay it back. In a way, the consumption-fueled borrowing binge is an illusion of wealth — after all, borrowing doesn’t increase my salary. Pleasure today means pain tomorrow.

…

It seems like the only people who don’t instinctively believe in credit-fueled growth are academic economists.

The academics have good reason for being skeptical. After all, production isn’t the same as consumption. In the example of me borrowing to buy a TV and car, my debt binge doesn’t make my salary — my production – go up at all. But in an economic boom, a country’s total production really does rise — that’s what fast growth means. In other words, if credit fuels economic booms, then it must do it in a fundamentally different way than the way it fuels a personal consumption binge.

…

If taking on debt lets a borrower increase his consumption, why doesn’t making that loan force the lender to decrease his consumption?”

This is an outright rejection of endogenous money and an embracing of loanable funds based thinking. The comment that lenders must “decrease” consumption is an obvious misunderstanding of banking. A bank does not have to decrease its consumption when it makes a loan. Loans create deposits from thin air. A well capitalized bank does not borrow reserves and multiply them or reach into its grab bag of deposits to make new loans. It endogenously expands its balance sheet to create the new loan and new deposit.

This money creation is indeed from thin air not unlike the way a corporation can create stock (a different form of financial asset) from “thin air”. All the bank needs is sufficient capital to meet capital requirements and the demand for the loan. If there is a reserve requirement then the Fed must necessarily ensure that there are sufficient reserves for the banks to meet its requirements. This is, for all practical purposes, an ex-post requirement and not the result of banks borrowing reserves or multiplying reserves before the loan takes place. Banks lend first and find reserves later if they must.

Importantly, a monetary economy is essentially constructed as a series of records of accounts to track how we make claims on goods and services. This system of records is a creation of the human mind from nothing. The entire monetary system is created from “thin air” and loans/deposits are just one form of asset/liability that is created within the monetary system. The money supply is no more fixed than my ability to conjure emotions from thin air. In essence, all of the financial assets/liabilities that we have created from thin air are simply accounting relationships that enable our ability to record how we interact within the monetary system. Bank deposits and loans are just one type of way we account for these interactions though they’re a particularly important type of interaction because they represent the primary medium of exchange in the system.

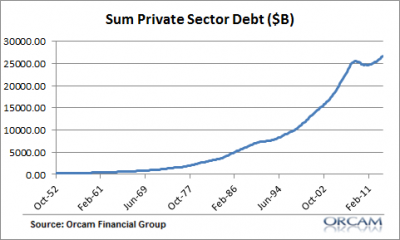

It should also be noted that loans don’t really get paid back in the aggregate. There is no aggregate “pain tomorrow” in the long-term. The financial system does not have a start and stop date like you or I do. Noah makes a fallacy of composition in claiming that an individual must repay loans. That is true at the individual level and false at the aggregate level. For instance, look at private sector credit trends and tell me where the stop date is:

(“Pain tomorrow”? Only in neoclassical economic fantasyland)

Of course, none of this means there can’t be short-term pain. Debt can increase at such a rapid pace coupled with unproductive output that it could cause an economic shock. That is essentially what we’re living through right now. Aggregate demand has been weak for several years, in part, because consumers have not been tapping credit to expand their purchasing power. Much of the housing boom was built on leveraged production and consumption that created a short-term disaggregation of credit. So we shouldn’t downplay the destructive potential of debt expansion.

Further, it should be obvious that much of private investment is funded with borrowed money. While debt does not create aggregate saving it can indeed finance investment as well as the consumption that fuels that investment. This funding of investment not only adds to saving indirectly, but drives the engine of the economy by increasing purchasing power and improving the net worth of the private sector when credit is used in a productive manner. If company XYZ builds a widget by borrowing money which a bank endogenously creates and then that widget is purchased by someone who also borrowed funds then it should be obvious that debt enables growth. The credit is the tool which enables the process of investment and production in this instance. Thus, in this sense, credit is an important enabler of economic growth.

I don’t know why academic economists can’t understand endogenous money. And I also don’t know why mainstream academic economists feel the need to brush off everything that isn’t orthodoxy – as if they’ve already discovered how everything in the world works. But we’re all worse off because of this closed-minded approach to economics.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

BernardKingIII

Good article. And I tend to agree with your points.

One question though. Why should banks have a monopoly on creating endogenous money? Why not let anyone create money by making loans?

Jonah Thomas

“Why should banks have a monopoly on creating endogenous money? Why not let anyone create money by making loans?”

When that is kept as a monopoly for a few people who have great political connections, it’s possible to keep it under control. The government can require banks to accept government debt if that becomes an issue. The government can tax banks, or accpet contributions or bribes from them.

But if anybody could do it, all that delicious power would be spread too thin to savor.

GC Edmondson wrote a novel, _The Aluminum Man_, in which a banker managed to acquire all rights to a great invention. The previous owner asked his mentor, “They stole from us. Why shouldn’t we just steal from them?”

“Ah, but they are a bank. They have a license to steal.”

It really does work like that.

Cullen Roche

Anyone can create money. But banks control the payment system. And the government essentially gives the banks the control of the system that they regulate. This essentially forms an oligopoly on the dominate payment system….So, you can create Bernard Bucks, but no one will accept them because you can’t compete with the quality, competitiveness or security of the banking system….

Ralph Musgrave

Cullen,

The difference of opinion as between you and Noah can be sorted out by distinguishing between where the economy is at capacity, and where it is not.

If it is not, then the extra demand stemming from more lending and spending is not a problem: there is no need for anyone to save, or cut back in any other way.

In contrast, if the economy IS AT capacity / NAIRU, and the extra lending and spending is not matched by “spending cuts and saving” by some set of individuals, then inflation becomes a problem. And there are various possible outcomes there, as follows.

1. The central bank may raise interest rates to stave off the inflation: net effect will (approximately) be to stifle any increased lending.

2. The authorities may impose a more deflationary fiscal stance, in which case the increased spending due to loans will be at the expense of public spending (or raised taxes).

3. Neither of the latter two occurs, in which case excess inflation kicks in, which cuts the REAL VALUE of all loans and debts. So again (approximately speaking) no extra lending takes place.

Dinero

If a toolmaker accepts an IOU from a carpenter in exchange for a saw and then the carpenter builds a chair with that saw , and the toolmaker later accepts the chair in exhange for the IOU we now have a saw and also a chair. And so credit can create wealth.

In principle a bank does not need a prior sufficient capital amount to meet capital requirements to make a loan , as it can get that capital amount by charging a loan arrangement fee. ie . it instantly ,at that point , has assets greater than liabilaties.

Geoff

An excellent, clear explanation of a critical subject.

pliu412

Credit is a necessary condition but not a sufficient condition for economic growth. Credits would not enable economic growth if they flow into non-investment or non-consumption spending in GDP production such as debt/interest payment, transfer payment, financial asset purchases, etc. The chart below shows US total credit level vs GDP

https://research.stlouisfed.org/fred2/graph/?g=KFY

Dinero

Noah Smith writes that borrowing to buy a TV ” …. doesn’t increase my salary.”

But it might do if the manufacturer of the TV buys services from his employer, – he overlooks the circularity of credit and commerce.

Bob Bobb

When trying to decide whether this idiot or Noah is right, the correct answer is neither. Try understanding the difference between nominal and real before speaking in public about money again, you illiterate.

Cullen Roche

Woah. So angry. The expansion of credit generates both real and nominal growth, but that had nothing to do with Noah’s post….

Dinero

man borrows money to buy TV + TV manufacturer pays man to make DVD player, man repays Loan. = result – DVD player created.

Frederick

Noah Smith doesn’t like Post-Keynesian economics because he can’t/won’t understand it. As a career economist his livelihood is at stake if he sides with a heterodox group. He knows it’s smarter to pick the “tried and true” economics path by engaging in the New Keynesian circle jerk. It’s a safe career move and also one that will leave him without a legacy of any kind worth mentioning.

Matthew McOsker

If I take out a loan to buy a newly constructed house for $300,000, then that money goes into many people’s pockets. And no, I do not have to pay the whole amount back tomorrow, but most likely over 30 years. The money spent from that loan becomes other people’s income, and it was created from thin air. Now, too much debt can become a problem, but the basic mechanics seem pretty straight forward to me.

Cullen Roche

Noah’s generally pretty open-minded about things which is why I think it’s so strange that he refuses to try to understand endogenous money. He was on Twitter asking how one could “exogenously” expand a balance sheet. That makes me think he just doesn’t understand accounting very well so maybe that’s where the real problem is. He also once tried to tell me that real estate is a financial asset so it would make sense that accounting is the barrier here….

Cullen Roche

Noah was working from a fixed money supply model. When he said that someone has to decrease their spending to allow someone else to borrow then it’s obvious that he’s thinking in loanable funds terms. The Galbraith quote has never been more appropriate. Noah’s mind is repelling the way in which banks create money….

tealeaves

Regarding the comment “It should also be noted that loans don’t really get paid back in the aggregate” can you clear up two points.

1. As you note over an individual’s lifetime they tend to pay off personal debt and reach positive net equity position. For an aging country, then why would the aggregate debt not also fall off as population declines?

2. Maybe related to the answer above, if we look at total debt per capita that measure like debt is increasing parabolically, yet no one really mentions that are total assets and equity per capita are also mirroring this parabolic rise. And so we could say that parabolically rising debt is not necessarily “unstable” because the corresponding assets/net equity are mirroring the parabolic rise in debt with a more stable aggregate leverage ratio. And so provided, the aggregate assets are fairly valued and the the aggregate leverage ratios remain stable then the rising aggregate debt and stable leverage in the economy may not be concerning. But of course short term solvency issues do occur during economic slowdown are and limiting the magnitude and duration of the economic slowdowns is critical. But those claiming we need to lower debt, may fail to see that this solvency problem exists regardless if the economy had 1/4 of the current debt or even double the amount of debt. That is, what is more critical is not the absolute level of debt but if the assets are fairly valued, and that the leverage ratios are reasonable. Personally, I’m unhappy with risk in this situation (i.e. housing boom) but I think this is the necessary outcome of a growth based economy.

This leads me to a the conclusion that the reason debt “increases” from generation to generation is that asset prices are “increasing” from generation to generation. And in aggregate, the rise and debt and assets is sustainable provided the higher priced debt back assets continue to produce even greater economic growth rates despite a shrinking population base (i.e provided productivity rises). Is this an accurate representation of this situation?

Dinero

Noah Smith is looking at a demand side credit transaction. Here is an example. An apple grower borrows money to buy an apricot . Later the apricot grower uses the money to buy an apple from the apple grower who then repays the borrowing. There the transaction, the trade of apple for apricot is fascilited by credit.

Dinero

The idea that Banking activity involves taking one customers deposit and lending to another customer is absurd when you take into account that deposits are liabilaties of banks, and not assets that can be lent. Athough ,that said , it is true that a deposit holder can lend their asset to another individual on account of it being to them, an asset. Each new loan creates a new asset, nothing needs to change hands between pre existing depositors when a loan is made. Deposits change hands when things are paid for not when Bank loans are made.

pliu412

Two ratios show how credits drive GDP, and stock markets:

(1) Blue line: the ratio of credits/GDP and (2) Red line: the ratio of credits/stocks

https://research.stlouisfed.org/fred2/graph/?g=IuY

John Daschbach

Cullen, how could anyone say “Why can’t academic economists understand Endogenous money” with a straight face? The headline rejects reality more than Noah’s piece does. Noah is a hard core ideological economist, not at all part of the mainstream. Most of the mainstream use DSGE models, which are almost certainly the best tools we have, and he has staked out an ideological opposition to DSGE models.

But mainstream New-Keynesian economists, who comprise perhaps the largest ideologically grouped set of academic economists, certainly understand and use endogenous money.

Just to list a few you may have heard of, Bernanke, Yellen, Wren-Lewis, …. Monetary policy requires endogenous money creation rates that a CB can influence at the margin through credit facilities. The whole basis for normal monetary policy (and one of the stated aims of QE) is to lower interest rates and thereby stimulated demand. As Wren-Lewis has pointed out, he has never talked with a macro-economist who thinks the money-multiplier is relevant to monetary policy. He goes on to point out that good first year economics textbooks describe endogenous money creation.

I don’t think that anyone capable of critical thinking could write your title with a straight face. Was it a joke?

Dinero

well it was a referene to a quote from the Noah Smith’s piece, and as the Bank of England have published a paper setlling the matter, it is up to Noah Smith to cite who these “mainstremm economists” are.

Cullen Roche

Your comments are pointless. You’re just trying to antagonize. You have no point. No value add. Nothing. Why do this every day on every comment?????

tealeaves

Can you offer more context on how you interpret these charts?

alhick

Banks don’t have a monopoly on money creation. Anyone who can create liquid short term liablities (e.g. deposits) can create endongenous money. “Shadow Banks” are just non traditional banks that create endogenous money.

mike

John Daschbach is possibly the best internet troll ever…just kills it every day on the PragCap comments

LoLattheUS

“because consumers have not been tapping credit to expand their purchasing power.” –

Because The People are broke. People actually have to be able to produce in the future for that credit based consumption today. If they have no job, a lesser paying job, or job uncertainty, even the slightly uneducated understand taking on debt may not be a wise decision.

Jack_C85048

That is the point this makes – they don’t have to produce.

The people are broke because the banks (and others) are hoarding all of the capital.

All of it is artificial.

tealeaves

I don’t disagree about the dangers of high debt to a household but I think some topics get mixed and “consumption” gets a bad rap. For example, what is the alternative to a credit based consumption economy?

A credit based investment economy (i.e china)?

A credit based government economy (i.e communism ala old Russia)?

A credit based export economy (i.e Japan ?)?

Aside from the communist model, all of these economies face a similar problem with an highly leveraged private sector that purchased an overvalued home and now needs to pay that off that debt. [Certainly lenders/banks, the Fed and government regulation were in some way complicit in this boondoogle and not just the debtor]. I wouldn’t pin the “problem” so much on debt based consumption as much as debt based asset speculation.

pliu412

In Jesse’s article, he shows how to estimate total stock allocation and supply of cash and bonds. https://www.philosophicaleconomics.com/2013/12/the-single-greatest-predictor-of-future-stock-market-returns/

“… The supply of cash and bonds that investors in an economy must hold perpetually increases with the economy’s growth. The cash and bonds in investor portfolios are literally “made from” the liabilities that real economic borrowers take on to fund investment–the fuel of growth”

Thus, we can compare the speed of credit expansion with GDP growth by ratio in blue line. Note that a rising ratio means the numerator/Credit Expansion is outperforming (up more/down less) the denominator/GDP Growth.

We can also compare the speed of credit expansion with equities growth by ratio in red line. Note that a falling ratio means the numerator/Credit Expansion is under performing (up more/down less) the denominator/Equities Growth. The dynamics of asset supply is an interesting framework for estimating future stock market return.

coolhead

Still not a complete picture.

At any given moment, a country’s capacity to produce goods and services are limited, even if everyone who can work are all working. The capacity is determined by many things such as technological level, social structure, etc. If credit is released to the amount that surpasses the gaining of the capacity, it creates inflation. This explains why there has not been inflation after 2009, because credit was destroyed before that. The FED’s credit expansion simply “fill up” the hole of credit.

SDB

Ok, Noah: “Here’s an alternative idea: Maybe credit is

a follower, not a driver, of the boom-bust cycle. Maybe credit grows when the

economy is growing, because of the need to finance investment, and shrinks when

the economy is shrinking, because of the lack of investment.”

That sure sounds like Real Business Cycle Theory…

But then, Noah ends the same paragraph: “Maybe the cycle was caused by

something else — productivity changes, or changes in monetary policy, or

changes in people’s sentiment and animal spirits.”

Fantastic… I mish-mash of RBCT’s main idea infused with Monetarism and Chapter

12 Keynesianism!

At the very end though Noah issues a potentially interesting challenge:

“Maybe excess credit really does force a boom to turn into a bust. But no one

has yet come up with a really compelling, testable explanation for how that

happens. … So this thing that almost everyone believes about the economy is

really just a conjecture.”

The worth of his entire article depends on this. Is he correct that no one has

come up with a compelling testable explanation for how excess credit forces a

boom to turn into a bust? … i.e., imo, the link-by-link causal mechanisms of

the so called Balance Sheet Recession. If he is correct, then it’s not all that

outrageous to call to it conjecture; or his words: “shaky analogies and bad

intuition”.

Then again, to even suggest from the get go that credit “doesn’t get you” economic growth seems absurd. It’s back to ‘money is just a veil’ nonsense.

-JK

Cullen Roche

Yep. Noah’s main point is precisely that – credit is just an intermediary in the model and doesn’t really have to be accounted for. As you said, it puts forth the myth that money is just a veil….

tealeaves

I like Jesse’s stuff and now see the thinking . The blue line I read as something like the total debt/yearly cash flow of the economy. The question is if the rising debt ratio over time is indicating that we are borrowing more from the future to fuel the growth in the current period. Or perhaps we might say GDP doesn’t fully measure the true economic “output”.

pliu412

Yes, GDP is just one of economic measures with production investments and consumption from sectors. We can also measure the ratio of credit expansion over sector net worth/net income.

Also, not all credits flowing into GDP production are used to fuel GDP growth. For instance, in NIPA accounts, we can calculate non-investment and non-consumption spending such as debt/interest payment, transfer payment, etc. Those kinds of spending from our borrowings are not used to fuel GDP growth since they are not considered as consumption spending.

LVG

What is wrong with all of these economists and their inability to understand debt and basic financial accounting. The only way the economy can continuously expand is if income is expanding. And if there is no growth in the supply of financial assets then no one can spend more than their income. One of the main ways we spend more than our income is by borrowing. Sheesh. This is basic accounting. It should be basic economics.

John Daschbach

Cullen, the fact is you can’t put together an argument based upon critical thinking. You don’t like your lack of intellectual skill to be pointed out.

Here was a very simple point that any college graduate, probably any high school graduate could understand. To say there is no point proves beyond any doubt that you lack skill at this level.

The point is quite clearly that you made what amounts to a completely untrue and easily proven false statement. And you can’t see the point!

I pointed out that most mainstream academic economists well understand endogenous money. And you think there is no point!

If the Fed thinks lowering interest rates at the margins for loan creation leads to higher employment then they understand endogenous money. Bernanke and Yellen understand this. And you think there is not point!

Simon Wren-Lewis says: “It is true that no macroeconomist I have ever talked to about this actually thinks the money multiplier is relevant to monetary policy today. And I am sure that Nick is right that good first year textbooks tell you that loans can create deposits as well as telling us about the money multiplier.”

And you stand by your claim that academic economists can’t understand endogenous money? Simon, a respected New Keynesian macro economist in England, at Oxford, is making exactly the opposite claim. And you can’t see the point!

Any middle school or high school teacher in the US teaches that you made a claim and I countered it with facts. The fact that you can see no value in what is taught at the pre-college level as the base level required to move forward in education is amazing!

I made a point that you are wrong. I backed it up with logical argument and now supported it with direct quotes. And you see no point and no value!

Either Simon Wren-Lewis is lying, or you are wrong. Please show the logic by which this has no point and no value. Otherwise, by the logic required to pass high school, you lack such skill. It’s a simple test, really. Prove Simon Wren-Lewis wrong, or admit that you made a false statement and then were unable to find the point.

Cullen Roche

Oh stop with your trolling. You don’t even understand Simon’s point. Simon believes we’re in a liquidity trap. So he believes the reserves -> lending transmission mechanism is just temporarily broken. He’s wrong of course, but you wouldn’t even know that because you don’t even understand his argument.

This is the problem with just about every comment you make – you THINK you’re making a relevant point, but you don’t even understand what you don’t understand. Here you are proving that you don’t even understand the point you’re using as evidence and yet you come here continually insulting people’s intelligence and telling them that they can’t think like a grade schooler. Do you realize how stupid you look when you write out such a rude comment like that that is based on your own misunderstanding?????

Besides, if you think my comments are so stupid then why do you read my work? If you’re so smart then why wallow in the stupidity of my website? Why not go troll some other website where you might actually learn something that is up to your incredibly high level of intelligence….

I’ve tried to be nice with you, but at some point this all gets a little absurd….Can’t you just try to be a little more humble, a little less insulting and maybe a little less argumentative????

Dale Eff

It seems to me companies and people can borrow money for two reasons, investment and expenses. If I borrow money to buy a consumable such as food, then my ‘pain’ is put off to a later date as I will have to repay the amount plus interest in the future. But if I borrow money to buy a car so I can continue to get to work, then I have invested in my future as I expect to continue to get paid in the future. The same for companies: if they borrow to meet payroll, then they are delaying ‘pain’; but if they borrow to build a new factory they are investing in a, hopefully, more profitable future which will be rewarded with higher profits.

pounce

You’re missing the shifting of wealth that goes to financiers and their financial services companies.

LoLattheUS

“The same for companies: if they borrow to meet payroll, then they are delaying ‘pain’;” –

That’s true for your small business owner, for government – it’s pulling forward demand through deficit spending. Will it matter? Who knows? I think it will long term, but since everyone is interested in their free lunch today, who cares?

Matthew McOsker

Yes, maybe Cullen’s title is a bit fantastic, but there is still a

lot of disagreement over the details around endogenous money. In this Noah case it is an utter rejection of it entirely.

There is a great deal of disagreement over the mechanics of endogenous money by some pretty high profile econ folks. The IS-LM model ignores the banking system, but many seem to rely on it. Many very intelligent economists believe that banks lend reserves, and that was a huge argument when QE started.

Here is one blog post covering the disagreement on the details:

https://uneasymoney.com/2012/04/11/endogenous-money/

This is a paper by Thomas Palley discussing the nuances:

https://www.thomaspalley.com/docs/articles/macro_theory/endogenous_money.pdf

Andrea

I am not sure I agree. First of all, Noah refers to the borrower and not to the lender when he talks about limiting consumption. That is hardly a refutable argument. You can have all the monetary tricks in the world, but when individual over-leverage, their future consumption will be curtailed. This is not the consumption by the banks that we are talking about.

Also, the idea the credit “never” gets repaid in full needs to be qualified. While it may appear to be so nominally, credit does get repaid in the form of constant underlying inflation. Constant positive inflation is in fact a feature of the modern monetary economies and has not been a common feature before.

Having said that, the role of credit in stimulating growth can be simply understood as a smoothing mechanism between consumption and savings. People earn wages by producing stuff, but stuff needs to be purchased and consumed now for people to make enough money to buy the stuff … etc …

alxmas

John, Your comment shows a complete lack of respect for a genuinely intellectual and worthwhile topic, please troll elsewhere. Some of your points might be worth considering, but that is lost once you accuse Cullen of lacking high school skills. I think the jocks might have posed more for of a threat to Cullen than the logic tests 🙂

Cullen Roche

I think this line is pretty clear:

“why doesn’t making that loan force the lender to decrease his consumption?”

Noah is obviously using a fixed money supply framework here. Maybe he didn’t intend to do that, but the whole article is basically a rejection of the idea that debt matters….If he’s not misunderstanding endogenous money then he’s definitely misunderstanding how crucial access to credit is in the health of the economy.

Andrea

Ok, I had missed that line, but you are right on that.

Willy1964

– Noah seems to NOT understand how “Double entry bookkeeping” works Like one Paul Krugman. Poor, poor Noah Smith. The credit creation process at a bank is different than when e.g. a government or a natural person creates debt & credit. But in both cases those entities use “Double entry bookkeeping” to create credit & debt.

– Noah is right that borrowing money doesn’t increase one’s production. What he overlooks is that by borrowing one can spend more than one earns, thereby increasing some else’s production. That’s why borrowing increases total production. Can some one point that out to Noah ?

Willy1964

– Agree. Debts that can’t be re-paid won’t. People, corporations & governments then default on their debts. And that’s the “Pain Tomorrow”.

spooninwithBakunin

I am a complete layman. But aren’t we arguing about how to increase the velocity of currency. Sorry if that sounds dumb. Endogenous money makes sense to me, but it seems like the only way to stimulate it is through bottom up GOV. spending.

Nick_Rowe

Cullen: sometimes things get lost in translation.

I’m fairly confident that Noah believes something roughly like this (he did re-tweet the link to this post): https://worthwhile.typepad.com/worthwhile_canadian_initi/2014/09/the-orthodox-new-keynesian-position-on-liquidity-preference-vs-loanable-funds.html

Plus, what I wrote in that post is possibly compatible(?) with what you wrote a week or so back.

Talking about “endogenous money” isn’t helpful. Because unless you have a model where the central bank holds the stock of money fixed, or growing at some fixed rate, (and Noah does not) then the stock of money will depend on other things in the model, which makes it (quite trivially) endogenous in the normal meaning of that word. This has nothing to do with the money multiplier.

Francois

“A bank does not have to decrease its consumption when it makes a loan. Loans create deposits from thin air. A well capitalized bank does not borrow reserves and multiply them or reach into its grab bag of deposits to make new loans. It endogenously expands its balance sheet to create the new loan and new deposit.”

I am sorry but I thoroughly disagree with this statement. This is an accounting illusion.

Let me illustrate this with a degenerated example. Let’s assume for one minute that it is very simple to create a bank. For simplicity, I even assume that there is no requirement for shareholder’s equity.

So I set up my own bank and grant myself a loan of $ 1 million. My bank thus ‘creates a deposit out of thin air’. The balance sheet of my bank is thus very simple. Assets: $1 million loan to Francois. Liabilities: $ 1 million deposited by Francois.

Does anyone really believe that my bank has created $ 1 million out of thin air by granting me a loan. Of course not! This is an accounting illusion.

It is an accounting illusion because if I try to use this million, I will immediately realize that I can not do so.

There are two ways to use that million. One is to go to my bank and withdraw the cash. However, my bank has no cash and therefore can not deliver.

The other way is to go to the bank and ask it to transfer the million to another bank. For that, my bank would need to have one million at the Federal Reserve, which is not the case. Again, my bank can not deliver.

That demonstrates that the accouting entry ‘$ 1 million deposited by Francois’ is in fact an accounting illusion. To make it a reality, my bank will have to do one of the following things:

– find real depositors who really deposit one million, either in cash or transferred from another bank.

– borrow one million on the interbank market, but that money will ultimately come from real depositors

– borrow one million from the federal reserve, but there is no guarantee that the Fed will want to do so.

Cullen Roche

You have to form a new bank with fresh capital and within the regulations of the Fed system so your degenerated example is an illusion….

Cullen Roche

I don’t think so Nick. Noah clearly states that someone must dissave in order to lend. This is wrong and causes problems for the way the New Keynesians state their views on the natural rate because investment is therefore not funded by tapping some supply of loan able funds. Ie, there is no interest rate at which the market clears at full employment.

I don’t gather that Noah thinks any of that….

BernardKingIII

Sure, I could create Bernard Bucks, but I can’t create the US dollars needed to make a $15 million dollar loan to finance a new condo development. So my question is more specifically, why give banks a monopoly on creating endogenous US dollars?

As far as creating Bernard Bucks as a competing currency, there are many more substantial roadblocks to competing with the US dollar/banking system than quality & security, e.g., laws which treat currencies as different from capital assets don’t apply to privately created money.

BernardKingIII

Really? Can a shadow bank create money to make a loan in exchange for a promise to repay?

Colin Twiggs

“Debt can increase at such a rapid pace coupled with unproductive output that it could cause an economic shock.” Seems to imply that debt grows at the same pace as output, which it does not: https://goldstocksforex.com/2014/09/21/amir-sufi-who-is-the-economy-working-for-the-impact-of-rising-inequality-on-the-american-economy/

Colin Twiggs

Credit and income

alhick

Yes, but it is a bit more complicated in American shadow banking becuase the differenct functions have been chopped up into different units, but the effect is the same. So say a bank packages a CDO and sells it to CDO wholesaler, this is making the loan. The wholesaler would be funded through the short term funding market, e.g. repo with a money market mutual fund, which is acting as the depositer.

The key is that the wholesaler is going to buy CDOs on a basis of how profitable it thinks they are and it’s cost of capital. Which is the same as a bank.

(Though it gets more complicated, because the wholesaler might try to sell it to someone else, so who counts as “making the loan” can be hard to say.)

Bob Bobb

The fact that you clearly don’t know the difference is sad.

BernardKingIII

Right, but in that case the wholesaler isn’t creating money because it’s essentially borrowing money from a money market fund and then investing it at a higher rate of return than it has to pay the fund in interest. If you are counting money market fund balances as part of the money supply, than yes, I could see how that could be construed as creating money – even though it’s essentially double counting.