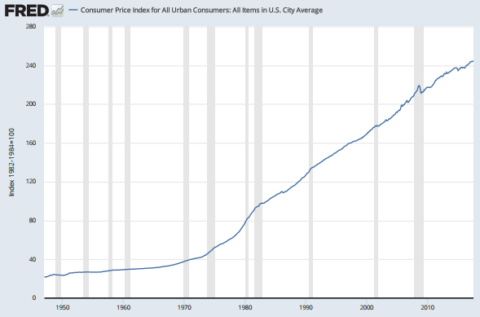

A common question I get: “why is inflation usually positive?”

It’s true. If you look at long-run inflation you’ll see a chart that pretty much always goes up. We measure the level of inflation using a basket of goods, but economists tend to ignore the fact that the basket always goes up in price and instead focus on the rate of change. Why is that?

The truth is we don’t fully know the right level of inflation (or the optimal rate of change). But one thing we do know is that a moderately low rate of inflation (such as 0-3%) is not inconsistent with rising living standards. For example, inflation in the USA has averaged about 3% over the last 100 years and yet living standards in the USA have soared.

Another thing we know is that a negative rate of inflation tends to coincide with disastrous economic outcomes such as 2008 (deflation usually means the economy is contracting very sharply). People sometimes cite the low to negative inflation of the 1800s as a period of economic boom. But the 1800s were also a period of disastrous economic busts and financial panics that included dozens of recessions, multiple real depressions and persistent bank panics. It was an extremely unstable period of economic growth that led to widespread social upheaval and actual Civil and World Wars. This was not the period of prosperity some people portray it as.

But back to the question – why is inflation usually positive? Some theories economists have:

- Prices are sticky. This is the theory that prices tend to have upward momentum. For example, you want your wage to increase every year because you presumably become more productive at your expertise. This puts upward pressure on the price level because you are constantly demanding a higher wage. Further, prices (and especially wages) tend to exhibit upward rigidity. That is, even when the economy slows or enters a recession wages tend not to decline. This sticky price factor puts a persistent upward pressure on the overall price level.

- Governments cause inflation. Governments create money and in doing so they can put upward pressure on prices. But governments don’t always engage in positive net present value endeavors. For example, defending the country during a war has a negative net present value in economic terms. You are building things only to blow them up all the while reducing the size of your workforce due to death. This isn’t the most economically efficient thing to do and that’s just one example of what governments often engage in. The entire operations of a government could be said to have a negative net present value in economic terms – operating the regulatory regime, courts, military, fire department, etc. These things have a negative net present economic value, but a very positive net present social value. So you could argue that a lot of government spending puts upward pressure on the price level because it’s essentially the price we pay for having rules, regulations, military, etc.1

- Businesses aren’t always efficient. 9 out of 10 businesses fail over the course of their life. In the process of doing so they will operate inefficiently at times, perhaps most of the time. This is all part of the process of creative destruction, but it can also be an inefficient process at times as businesses waste money on endeavors that are deemed, in the long-run, to be inefficient. This can put upward pressure on the price level as more productive entities outcompete the less productive entities. In aggregate competition should keep prices low, but the process of price discovery often entails an inefficient route with many failures along the way.

- Money is elastic. We reside in a credit based money system. A fixed money supply system has never worked in human history. Credit systems always grow from a fixed system for numerous reasons.2 And this elastic money supply means that the money supply will usually rise to meet the growing needs of the society using that money. This elasticity can be good and bad. At times it can be abused by governments or the private sector and lead to booms that result in busts. At worst, it can result in high inflation or hyperinflation. Credit based money systems are adaptive due to their elasticity and this is usually a good thing, but it doesn’t mean things can’t go very wrong with an expanding money supply.

1 – This doesn’t mean government spending can’t have a positive net present value. It just shows that government spending is not necessarily a net present value operation. That’s kinda the whole point though. It’s hard to make money operating a military so the private sector prefers not to do it. The government is utilized primarily to engage in operations that the private sector sees as having a negative net present value even though these operations might have a positive net present social value.

2 – The reasons include: hoarding, population growth, inequality, opportunity costs of saving, etc.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.