I am a huge fan of index fund investing. I use index funds in my approaches and I can’t emphasize how important it is to maintain a low fee, diversified and tax efficient investment structure. When it comes to creating an efficient portfolio approach there is, in my opinion, no better way to do this than using low fee and tax efficient index funds.

I have a minor beef with some other indexers though. I am probably being overly precise and anal in my views here, but I don’t like the way some index fund advocates promote their approach because once one looks at this from the macro perspective it becomes clear that many indexers are hypocritical and employ a much more “active” and forecast based approach than they imply. Let me explain.

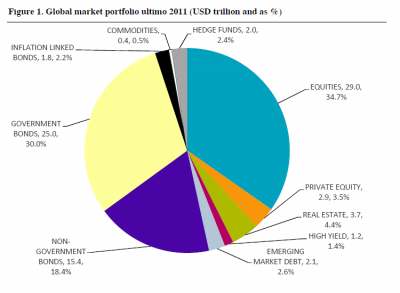

The nice thing about taking a macro approach like mine is that we can get a very clear 30,000 foot view of the world. If we look at the world’s financial assets in aggregate then there’s obviously just one portfolio of all the world’s assets. This can be thought of as the ultimate benchmark for global assets. As I’ve previously noted, this study comes pretty  close to establishing what that portfolio looks like. It’s roughly a 55/40/5 bonds/stocks/alternatives allocation. When you establish a portfolio that is different from this then you’re basically saying that the global asset portfolio is wrong and that you can outperform it. You’re declaring that you’re smarter than the global asset portfolio.

close to establishing what that portfolio looks like. It’s roughly a 55/40/5 bonds/stocks/alternatives allocation. When you establish a portfolio that is different from this then you’re basically saying that the global asset portfolio is wrong and that you can outperform it. You’re declaring that you’re smarter than the global asset portfolio.

I’m probably being too hard on indexers in general here, but the reason I find this interesting is because it means that most indexers are actually active index pickers. A 70/30 stock/bond advocate is saying that he/she is smarter than the global financial asset portfolio and can pick funds better than the aggregate because they think they can forecast the returns of equities relative to bonds better than the aggregate. Just like the stock pickers that indexers often demonize for picking assets inside a broader aggregate, they too end up picking indexes inside of this global index. Index fund investors often berate people for trying to “beat the market”, but that’s precisely what they’re trying to do when they construct anything other than the global index. The fact that picking indexes is more efficient and generally less risky than picking stocks doesn’t mean they aren’t actively picking assets or trying to “beat the market”, but that’s generally how the approach is portrayed.

Of course, no one can buy the global index perfectly and it wouldn’t even be appropriate for everyone to do so because we all have differing risk tolerances and financial goals. But it just goes to show that we really are all active investors and that the key to portfolio construction is not about getting caught up in whether you’re “active” or “passive”, but really it’s about creating the portfolio that’s most efficient for your personal needs.

Related:

- Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance

- Debunking some Common Investment Myths

- We Are All “Active” Investors

- Most Index Funds are Macro Funds

- Putting the “Underperformance” of Active Managers in Perspective

- Of Course 80% of Active Managers Underperform the Market!

- There’s no Such Thing as “Forecast Free” Investing

- The Importance of Understanding Your Implicit and Explicit Forecasts

- The Importance of Understanding Your General Portfolio Framework

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.