On Sunday evening, before GameStop had fallen 85% from its peak, I said:

I can’t lie. I am really mad to be right about this. Mainly because all of the narratives surrounding this whole charade have been so disingenuous/misinformed and a lot of famous people promoted those bad narratives along the way. And now we’re finding out that a lot of small retail investors are left holding the bag. In fact, we’re finding out that hedge funds made a lot of money at the cost of retail investors. So, what happened here? How can we try to avoid this again in the future?

One of the worst narratives that started this whole thing had to do with how short sellers are bad. The basic story was, “short sellers manipulate companies lower than they otherwise should be and hurt firms and their employees”. That sounds bad. Except, as I explained previously, the mechanics of short selling also create buyers. There’s nothing inherently good about buying or selling stocks. So, the key question has to be, does short selling drive stocks below their intrinsic value? No one can be certain about the intrinsic value of a stock, but one thing we do know is that short sellers have never ruined a great company. After all, this is like believing that a person betting against a horse at the track can meaningfully make the horse run slower by placing a bet that the horse and rider don’t even know about. It just doesn’t make sense. For the most part, secondary markets don’t directly influence the firms and their operations. So, it would be extremely difficult for short sellers to kill a business. Further, the academic research on this matter is pretty black and white – prices are actually less efficient when short sellers are less involved in pricing securities.

But I am not here to defend short sellers and make them appear righteous. I am sure there have been plenty of cases where short sellers spread misleading narratives and helped to drive down the price of a stock below its intrinsic value. But what I want to highlight is that short and distort schemes are no more harmful than pump and dump schemes. And that’s the frustrating thing about GameStop. While the narrative initially started as a company that was being shorted and distorted it actually ended up turning into a massive pump and dump promoted by many famous people.

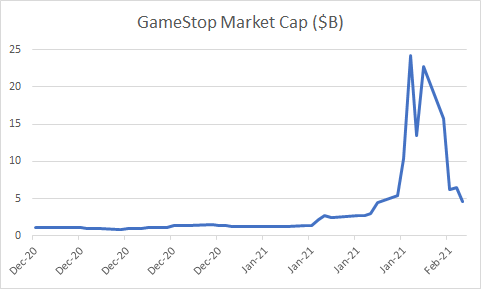

But why is a pump and dump dangerous, you ask? Doesn’t everyone just get rich? Isn’t it good when stock prices rise in value? Yes. But when a stock price rises unsustainably above its intrinsic value that can be just as harmful as when it is distorted below its intrinsic value. For instance, let’s take a real-time example of GameStop. Below is the market cap of GME. That’s the total market value of all those shares outstanding.

Now, to understand what’s going on here it’s helpful to understand the basic dynamics of a trade. I am going to simplify things for the sake of establishing basic understandings…In early December of 2020 you could have purchased the entire GameStop entity for something close to $1B. That is, if you had a billion dollars you could have gone out and exchanged $1B of cash for every outstanding share of GME. Sharesholders get $1B of cash and you get $1B of a paper certificate tied to the future value of GME Corp. By late January that same entity would have cost you $25B to purchase outright. Despite the fact that nothing materially changed about the firm. And now we know that that figure was wildly wrong. So, where did the money go? It went to other investors. When you sell your stock there is a buyer. In this case the hedge funds who sold at $500 per share were selling a share of stock that was wildly overvalued in exchange for $500 of cash per share. The hedge funds got cash and you got an inflated stock certificate. Importantly, that stock certificate is an endogenous financial asset. It is not unlike the horse track ticket in the sense that its value can change over the course of time that GameStop is running their business. It could go to $0 and it could go to $1T. If you’re one of the people left holding GME stock then your balance sheet is slowly being marked down and someone else is holding the cash you gave them at the inflated value.¹

So, what we had here was a good old fashioned pump and dump scheme. GME hadn’t changed. Sure, maybe the company wasn’t worth $1B. Maybe the shorts were distorting it lower than it otherwise should have been. But there’s also no world in which a $25B valuation makes sense. So, when all those famous people were pumping GME up they were creating an inherently unsustainable environment. And retail investors dove in thinking that this was somehow a good thing.

The reason this frustrates me is because a pump and dump is massively more dangerous than a short and distort scheme. For instance, let’s say GME is actually worth $5B. That’s not a totally unreasonable assertion. So, you could argue that the short and distort scheme was reducing the value of GME by $4B. That’s $4B of value that someone in the economy should have on their balance sheet. But let’s consider this pump and dump where our presumably $5B company is now valued at $25B. This creates $20B of fictitious wealth. In other words, it’s $20B of soon to be worthless race tickets praying for a horse with a broken leg to win.

In the end it’s the ponzi aspect of a pump and dump that makes it so dangerous. After all, as a short and distort scheme plays out the size of the pool of money actually SHRINKS. Whereas the pool in a pump and dump actually grows. So more investors got sucked into the game at the worst possible time. This means that the pump and dump ends up being much more broadly destructive than the short and distort scheme can ever be because its success relies on pulling in more money at the worst possible time. Said differently, there is a bigger multiplier effect in the damage of a pump and dump because the size of the pool’s growth impacts so many more people.

Everyone should be mad about what happened here. But short sellers are just one of the bad players in all of this. And even if they were involved in a short and distort scheme it’s really the pump and dumpers who we should be the most angry with. After all, they did far more harm to retail investors than short sellers did along the way.

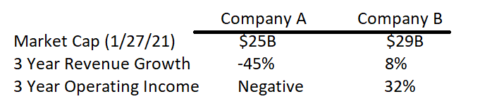

¹ – I know, I know – “intrinsic value” is a messy term here. I don’t know if GameStop is worth $1B, $5B or $0. But intrinsic value is necessarily a relative value analysis. For instance, if you had $30B sitting around in your bank account and you wanted to buy a retail electronics company would you rather buy Company A or Company B:

Again, I am massively over-simplifying things for the sake of basic communication, but Company A is GME. Company B is a little company called BestBuy. Both are brick and mortar electronics stores. One has collapsing revenues, loses hundreds of millions per year and has $0.5B in cash. The other has solid revenue, generates billions in income and has $5B in cash. So ask yourself – if you had to do a relative analysis on these two entities would you ever in your wildest dreams consider paying $25B for GME when you could buy a company like $BBY for $29B? There’s no world in which these two entities can be remotely valued similarly and yet that’s what was being sold to people.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.