Rand Paul has some rather extreme political views. And as someone who wishes the political debate would veer back towards the middle I tend to take issue with some of his political views. His budget proposal is an excellent example of this extreme thinking and how extremist thinking can be intuitively attractive, but economically damaging. Below I will walk through a very basic overview of why I think the extreme changes in his budget proposal would actually make the economy worse off.

Let’s keep this relatively simple. One entity’s spending is another entity’s income. So, if we all stop spending then we all have that much less income. We can’t all save our way to prosperity. Some entity has to be spending more of their income in period 2 in order to create growth relative to period 1. Whether this is “efficient” or increases living standards is a totally different discussion, but from a pure accounting perspective the reality should be clear – we rely on constant balance sheet expansion in order to sustain growth.

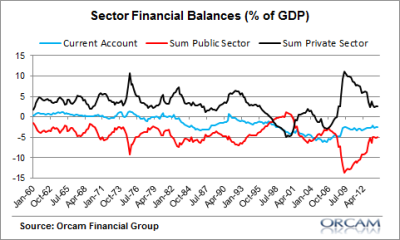

We can look at the entire economy as basically existing on 4 balance sheets – the household sector, the business sector, the government sector and the foreign sector. Here’s the 3 sector view of this as Wynne Godley depicted it:

A few big things stand out in that chart above:

- The government is a persistent debtor.

- The current account is net negative meaning that the rest of the world has a net positive position against the USA (think of this as income leaving the USA).

- The private sector’s saving is driven in part by the government’s deficit. That is, the government’s deficit is the private sector’s surplus.

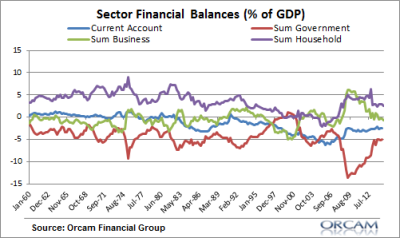

Of course, that 3 sector model consolidates the most important part of the entire economy – the private sector. So we have to dig into this further because the private sector’s balance sheet is comprised of much more than just the government net financial asset position and the current account balance. In the following chart we can see the 4 sector financial balances:

Businesses, like the government, tend to be debtors. In fact, if we look at household balance sheets we’ll find that corporate liabilities and corporate equity (a contra asset for firms as a whole) comprise the majority of household net worth.

Rand Paul’s budget plan seeks to maintain a budget surplus starting in the year 2018. He’s planning to reduce the government’s deficit by $1.1 trillion between now and 2020 relative to the CBO’s estimates. But the important question to ask yourself is what sector will offset this lost income? It’s unlikely to be the foreign sector because the USA has been a persistent current account deficit country for the last 30 years. The household sector is still recovering from their own debt boom during the housing bubble so I think it’s safe to say that they’re not going to become the net debtor. And corporate America is spending at rates that are also at 30 year lows. In other words, to offset the lost income from the government some other sector has to pick up the slack to maintain what has been a pretty weak recovery. Who is going to do that? I just don’t see where the lost income will be made up. And that means weaker economic growth going forward and potentially recession.

And that’s the kicker. If Paul’s budget proposal were to get passed I think there’s a very high probability that no other sector would sufficiently offset the lost income from government. And if that materializes then the risk of recession actually increases. And if the economy starts to contract again then automatic stabilizers will kick in and the budget deficit will actually RISE because more and more people will file for unemployment claims and government aid. In other words, while Paul’s proposal might make sense on the surface there’s a very high probability that it would simply weaken the overall economy and result in a HIGHER budget deficit than we presently have.

The problem is that this economy is still too weak for seismic shifts in the government budget. The time for big budget changes is when the private sector is booming and healthy. Unfortunately, we’re still too fragile to handle big shocks to the economy and I think Rand Paul’s budget would be a substantial shock to an economy that simply cannot handle it at this time.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.