“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone

I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real estate, cars, collectibles, art, Bitcoin, stocks, bonds, etc. Some of these items will lose value over time. Others will increase in value. You diversify specifically because you never know the future. But at the core of this portfolio are stocks and bonds. Why? Because everyone needs a high degree of certainty about the future of certain assets in their Total Portfolio. And stocks and bonds are the primary assets in the spectrum of assets that provide us with somewhat predictable cash flow streams over very specific time horizons.

I’ve written a good deal about how all of asset allocation is a “temporal conundrum”. In other words, we all have specific time horizons on certain liabilities – your rent, your mortgage, your credit card bill, etc. And the key to good financial planning is matching those liabilities with certain assets that are very likely to provide liquidity for those future expected expenses. Your biggest asset is your labor and the predictable income stream that it generates for you over time. But you also need a portfolio of other assets that are likely to provide you with supplemental cash flow streams over time. Especially if you ever want to retire.

This is why stocks and bonds play such an important role in your portfolio. Most of us won’t generate predictable cash flows from owning our house, cars, art, Bitcoin and other non-cash flow generating assets.¹ So stocks and bonds play a crucial role in asset allocation specifically because they provide those predictable cash flow streams. While markets may not be perfectly efficient it’s actually quite rational that these two markets make up the vast majority of the global financial markets – investors like to own them because they generate somewhat predictable expected returns over specific time horizons.

To be clear, I am not at all averse to owning all that other stuff. Real estate, physical assets, commodities, gold bars, Bitcoin, collectibles, Beanie Babies, etc. If you want to own that stuff I think that’s great. But we need to separate cash flow generating assets from non-cash flow generating assets because the latter doesn’t provide us with the predictable cash flow streams that allow us to prudently prepare for the future.

But Stocks Are Overvalued!

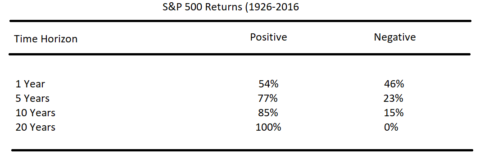

It’s true. Stocks are overvalued by most metrics. They’re very likely to generate lower risk adjusted returns going forward than they have in the past. So what? You could have said that at many points in the last 20 years. The key to understanding stocks is in putting them in the proper temporal bucket. For instance, I always say that I like to think of the stock market like it’s a 30 year high yield bond with a 7% coupon. If you have a long time horizon the likelihood of you losing money in that instrument is extremely low because the cash flows from Corporate America over very long periods are highly predictable.

(Likelihood of losing money in stocks over specific time horizons)

Now, this doesn’t mean it’s imprudent to manage the risk in your stocks. Set it and forget it doesn’t work for everyone. In my opinion, for certain people, it makes a lot of sense to rebalance your stock portfolio dynamically to take advantage of tax efficiencies and cyclical events that change the future expected returns of this asset class. 60/40 isn’t the right choice for everyone. But that doesn’t mean we should abandon stocks entirely.

But Interest Rates can Only Go up!

I started in this business over 20 years ago and I can still remember my first boss telling me this exact narrative. A portfolio of long-term bonds has generated 6.5% per year since then. Of course, that’s not gonna keep happening. It literally can’t keep happening because rates are low and current rates are the best predictor of future returns. And yes, you’re right that bonds will generate lower risk adjusted returns going forward. I’ve stated that repeatedly. But it absolutely does not mean that bonds will generate negative returns. As I’ve written about exhaustively, it’s absolutely wrong to say that bonds will necessarily lose money if interest rates rise. In fact, we know from the history of the rising rate period of 1940-1980, that bonds did just fine. A 10 year T-Bond generated 3% annualized returns over this period.² How is that possible? It’s possible because that 10 year T-Bond kept maturing at par regardless of what interest rates were doing. So, even if you bought bonds at the worst possible time in the early 1940s you still clipped that 2% coupon every year until the bond matured.

Better yet, a simple portfolio of 50% stocks and 50% bonds generated 7.5% annualized returns from 1940-1980. Not bad!

Of course, if you took that 10 year bond and you treated it like a 10 month bond then you ran into problems at times. But this is all part of the temporal conundrum. If you have a 10 month time horizon on your assets then you shouldn’t be buying 10 year instruments in the first place. You just create a temporal imbalance in your portfolio which leads you to the risk of behavioral biases. If, on the other hand, you have a 10 year time horizon and you know the duration of certain liabilities then you can begin to predictably match the appropriate amounts of cash, short-term bonds, medium term bonds, long-term bonds and stocks to those specifics liabilities. Sure, you’ll generate lower returns than if you hit the gas on stocks or other high risk assets, but you trade certainty for returns. That’s just how this game works. And that’s why everyone ends up owning big chunks of cash at pretty much all times.

Look, I am a big fan of managing the risk in a portfolio. We are all active investors and we all need to navigate the unpredictable future by making active decisions about our portfolios. But it’s also important to keep things in perspective and maintain a prudent approach to portfolio management that optimizes that risk management for the temporal risks you’ll inevitably encounter across your life. And this is why stocks and bonds have always (and will always) play such an important role as the core of any diversified portfolio – because most of the other assets we own simply cannot provide us with the predictable cash flow streams across specific periods of time.

¹ – This is obviously not true for everyone. Apologies for generalizing. Also, this is a very different situation when you turn one of these assets into your labor and investment. Eg, if you run a Property Management Company then real estate becomes your core cash flow generating asset.

² – Bonds lost money in real terms over this period. Which isn’t surprising because bonds aren’t designed to beat inflation. They’re designed to provide principal stability and cash beating returns. Which is exactly what they did during this time period. If you wanted inflation protection you needed to own other assets like stocks, gold, etc.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.