Okay, I promise I’ll stop harping on this for a while after this post, but I feel like the message isn’t getting through so let’s try this one more time because I think it’s pretty important….

The concept of endogenous money (the idea that banks create money independent of their reserve position as espoused by the idea of the “money multiplier” or fractional reserve banking) has come to the forefront at several points during the last 5 years. The financial crisis was an important turning point in economic thought because it exposed the reality of how banks create money. When Central Banks around the world flooded banking systems with reserves there were concerns that these reserves would be “lent out” or that they would somehow release into the economy thereby causing high inflation. Economists had varying explanations for why this was the right or wrong view, but very few of them explained it through the lens of proper banking operations.

As the crisis unfolded it slowly became clear that the money multiplier view espoused by many mainstream economists was at best deficient. Federal Reserve researchers rejected the money multiplier. The BIS rejected this concept. And most recently, the Bank of England has rejected the idea. But most mainstream economists have ignored these rejections or attempted to sweep them under the rug as being views that are no different than what they have always thought. Of course, to those of us who understood endogenous money and predicted in real-time, that reserves wouldn’t cause high inflation or more lending, it was always obvious that the sands were shifting beneath the feet of mainstream economists and that they never really understood the concepts to begin with.

This issue strikes at the core of the way many mainstream economists view the monetary system. I’ll try to explain this in layperson’s terms so anyone can see why the mainstream view is flawed:

- Most mainstream economists believe in a “natural rate of interest” at which markets clear and the economy reaches equilibrium.

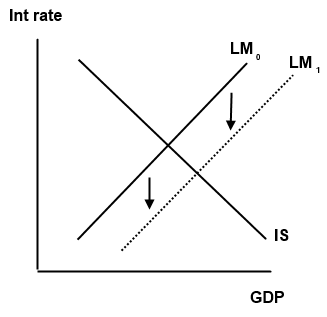

- This view is often displayed through the use of crude and unrealistic models such as the IS/LM model. The LM curve of the IS/LM model assumes that exogenous injections of base money should normally reduce interest rates and boost demand (or vice versa). This is generally presented like this:

- Under this view, once interest rates fall to zero they reach what’s referred to as the “zero lower bound” where nominal rates can go no lower. If there is a strong preference to hold any extra money that is injected into the system then this doesn’t result in higher inflation (because banks won’t “lend it out”). Therefore, the addition of more base money loses its power to drive growth higher. And most mainstream economists will argue that this is a sign that the “natural rate of interest” is actually negative. Therefore, the economy won’t reach equilibrium, prices won’t clear, inflation will remain low and unemployment will remain high. For years now, we’ve seen economists using some variation of this description to argue for altering expectations (to reduce real interest rates), implementing negative nominal interest rates (to entice currency holders to spend or lend their balances) or to implement other policies.

- The key flaw in this view is that it defines “money” as the monetary base or assumes some direct relationship between bank money and central bank money (thus marginalizing banks as simple intermediaries and often used as rationale to leave banks entirely out of the presentation). But when you understand endogenous money you understand that the size of the monetary base only indirectly influences the amount of broad money that banks issue. There is no direct relationship between the monetary base and broad money as we learn in Econ 101 textbooks. And since banks issue money which is pari passu with base money then leaving broad money out of the equation is a pretty substantial oversight. So these models which display a direct relationship between interest rates, the money supply and output are highly misleading since they create a pure fiction of our actual monetary system.

- When you understand that banks really do create money endogenously and can thereby increase aggregate demand independent of what the monetary base looks like then the old monetary base model looks a lot less useful than many presume.

- More importantly, this view calls into question the traditional presentations of things like loanable funds, the quantity theory of money, the money multiplier, the natural rate of interest and many other broad economic myths.

- This isn’t some minor little issue in mainstream economics that can be swept under the rug through some tweaking or rewriting of the history books. I’d go so far as to argue that it could require some economists to reconstruct the paradigm through which they view the economy. Paul Krugman says “paradigming is hard”. Which is true, but only if you’re totally unwilling to explore new paradigms and drop the ones which are obviously wrong.

* I’d say that this will be my last attempt to explain why this matters, but given the fact that mainstream economists refuse to understand it, I am certain that the problem will keep reappearing because mainstream economists will keep making flawed policy recommendations and incorrect predictions based on what is clearly an incorrect understanding of the modern monetary system….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.