With a change in the US Treasury Secretary soon taking place I get to play fantasy world and imagine how I would handle the transition if I were nominated.¹ One of the common ideas these days is that we should be “refinancing” government debt and “locking in” low rates. Soon to be Treasury Secretary Steven Mnunchin recently said:

“we’ll look at potentially extending the maturity of the debt because eventually we are going to have higher interest rates and that is something this country is going to need to deal with.”

This makes sense at first. After all, as individuals we’re trained to reduce our interest costs because this reduces our solvency risks. The same is not necessarily true for the US government, however, and if I were nominated Treasury Secretary I would actually be doing the exact opposite – I would be reducing the maturity level of new debt issuance.

First, here’s why I think the argument for longer dated securities is wrong:

- The US government has extraordinary financing flexibility as the dominant reserve currency country in the world (i.e., the likelihood of a hyperinflation or currency crisis remain extremely low). More importantly, unlike households and corporations the US government does not have to worry about a traditional solvency constraint, as in, running out of money it can print.²

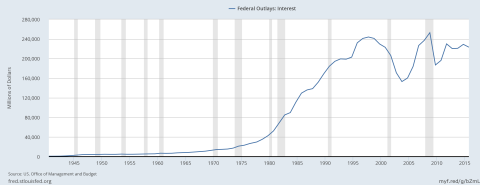

- Current public debt is about $19,900B. Despite the recent increase in total debt the US government’s annual interest costs have been relatively flat for the last 20 years as a reduction in interest rates has offset the quantity of debt issued.

- As I explained in Myth 10 here, the interest burden does not pose a realistic solvency risk for the US government. There is no reason for rising interest rates to cause an uncontrollable surge in interest costs. In fact, if we’re smart about how we manage this there is no need for interest costs to become an excessive portion of the federal budget.

- The current average weighted maturity of US debt is about 5.8 years. At current interest expenses the US government is paying about 1.2% on its total public debt. Because 87% of the national debt outstanding is less than 10 years in maturity, an increase in the maturity profile would actually INCREASE the current and future interest burden. With a 3.1% 30 year T-Bond the US government would almost certainly have to pay much higher rates than 1.2% to issue a 50 or 100 year bond.

So, the math on issuing long dated bonds is pretty clear given that the average current weighted maturity is so low. But I would go further. I would actually reduce the average weighted maturity of 5.8 years by issuing more Treasury Bills and fewer longer dated securities. Here’s why:

- The demand for short dated debt is extraordinary. With an average bid to cover of 3.8 for 26 week Bills in Q3 auctions, the demand is 65% stronger than 30 year T-Bonds. It’s commonly repeated that we’re seeing a “reach for yield”, but it’s clear from T-Bill demand that we’re really seeing a demand for safe stable assets even if they don’t pay much interest. Investors are more concerned with a return OF their principal than a return ON their principal thereby making T-Bills a very attractive option given their risk-free nature.

- By reducing the average weighted maturity the Treasury can better align their targets with their partners at the Federal Reserve. Since the Fed is the monopoly supplier of reserves and the setter of interest on excess reserves they can effectively control the cost of the national debt if it is comprised of short dated maturities. This is far preferable to relying on longer dated bonds which are increasingly influenced by forces outside of the control of the Fed and the Treasury.

- Greater control of interest costs will increase policy flexibility which will alleviate the public’s fears over the interest burden and expand the potential for other fiscal policy options.

- Paying low interest rates on the national debt is smart fiscal policy management as much of the interest costs goes to intra-government debt payments, foreign debt payment and payments to the wealthy who have a lower propensity to consume.

The Treasury should indeed reduce its interest costs in the coming decades, however, this isn’t best achieved by issuing long-term bonds. Contrary to common belief, it is best done by issuing more short-term bills.

¹ – “Fantasy” is probably the wrong word. In the post-factual world we’re living in, being the head of the US Fed or Treasury would probably drive me into a significant alcohol problem as bearing the brunt of the endless conspiracy theories would be unbearable. Of course, this assumes that anyone with a brain would nominate me to do anything in the US Treasury other than plunge toilets, which, for the record, I am quite experienced in.

² – See myth #3 for more specifics on this point.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.