I love using charts as a supplement to a broader perspective. Sometimes, glancing at a picture is the easiest way to absorb the current trend in a market. This can be enormously helpful when gauging risks and entry/exit points. As part of a bigger strategy, charts are not only helpful – I’d say they’re a downright necessity in properly gauging the big picture.

Yesterday, I discussed how stability breeds instability and disequilibrium builds within the illusion of stability. With charts, you can sometimes visualize the psychology of the market and the driving force that leads to instabilities and creates environments of excessive risk.

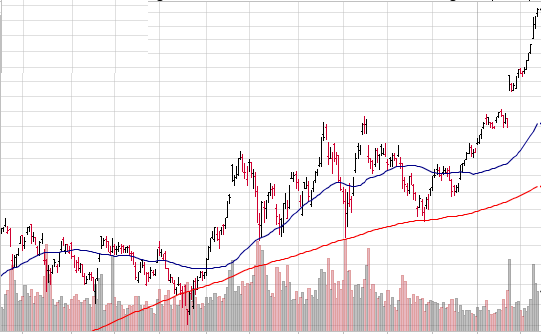

With that said, I don’t have an investment prediction, but rather a thought experiment for readers that might help understand this particular component of my outlook. Would you buy the following stock for a brief holding (2-3 months)? If so, why? If not, why not? I’ll follow up on the post later tomorrow after some discussion has unfolded….Maybe we can make some broad conclusions that help us all better understand risks and gauging market movements….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.