Janet Yellen gave a very good speech yesterday in Denver in which she defended the Fed’s policy of QE. She provides a fairly rigorous analysis of the program. The key paragraph follows:

“Turning now to the macroeconomic effects of the Federal Reserve’s securities purchases, there are several distinct channels through which these purchases tend to influence aggregate demand, including a reduced cost of credit to consumers and businesses, a rise in asset prices that boosts household wealth and spending, and a moderate change in the foreign exchange value of the dollar that provides support to net exports. The quantitative magnitude of these effects can be gauged using a macroeconometric model such as FRB/US–one of the models developed and maintained by Board staff and used routinely in simulations of alternative economic scenarios.”

She then concludes the speech by saying:

“In closing, let me reiterate that the program of asset purchases initiated by the Federal Open Market Committee in November is intended to support economic recovery from an exceptionally deep recession and to restore inflation to, but not above, levels that FOMC participants consider consistent with price stability. It will not be a panacea, but I believe it will be effective in fostering maximum employment and price stability.”

I have to commend Yellen for at least displaying a sound understanding of the banking system. Alan Greenspan, who was interviewed by the WSJ this weekend displayed the exact opposite understanding. Specifically, the comments by both regarding excess reserves are near opposites, but Yellen gets it dead right. Unfortunately, Yellen appears to be waving the team flag and nothing more when considering the positive effects of QE. Her comments can be easily refuted by looking at the facts.

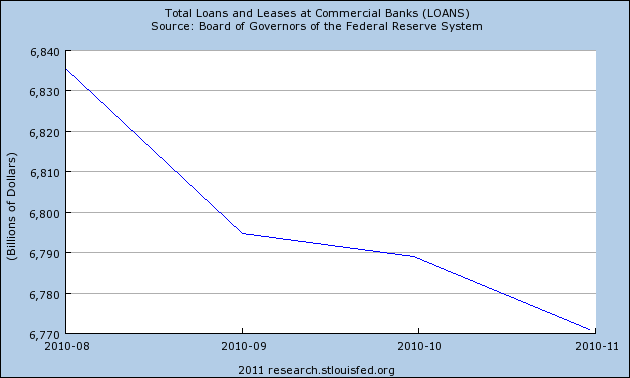

1) She says QE is positively influencing the consumer’s cost of credit. That’s obviously nonsense. Mortgage debt now accounts for 75% of consumer credit and the average mortgage rate has risen to 5.2% from 4.2% in September. The average mortgage payer has no perception of expected inflation rates. With more than a quarter worth of loan data now in the books since the inception of QE the facts speak for themselves. Loans are not increasing so QE2 is obviously not generating a surge in borrowing due to the “reduced cost of credit”:

2) The wealth effect is obviously the mechanism the Fed is targeting here. The effects are highly debatable. Karl Case and Robert Shiller claim there is no impact from the equity market wealth effect. Either way, I believe this is a dangerous strategy. Nominal wealth creation via asset inflation is a very dangerous economic strategy. We should all understand this following the tech bubble and the real estate bubble. Asset markets that are intentionally diverged from their underlying fundamentals create a dangerous disequilibrium. The Fed should be targeting real underlying fundamentals as opposed to creating asset price inflation that most likely leads to irrational exuberance and eventual nominal wealth destruction. So, the positive impacts are highly controversial here, but I would argue that the final impact of the Bernanke Put will not result in a happy ending.

3) Yellen claims foreign exchange impacts can impact trade, however, the change in the value of the trade weighted dollar is practically negligible since QE2 was initiated so this is obviously not driving economic growth.

Overall, Yellen’s comments display a high level of competence when discussing the monetary system, however, her comments regarding QE are disingenuous at best. The Fed has made itself clear in the last few months – they are relying on an equity market recovery to generate a sustained economic recovery. I personally think that’s a highly dangerous approach to economic growth. If past is prologue we appear to be barking up the wrong tree again when it comes to sustained US economic growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.