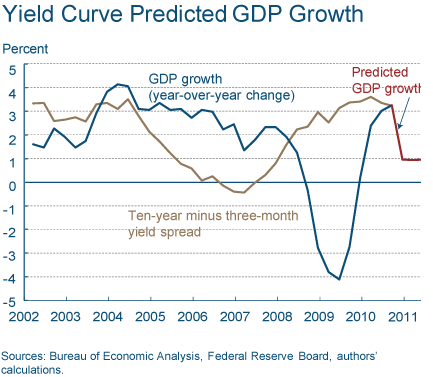

According to the latest estimates from the Cleveland Fed GDP is expected to come in at about 1% based on forward projections from their yield curve model:

“Continuing a recent trend, the yield curve became steeper over the past month, as long rates increased nearly 0.2 percent, and short rates inched up. The three-month Treasury bill rate moved up to 0.15 percent—just above November and December’s 0.14 percent. The ten-year rate rose to 3.36 percent, up from December’s 3.18 percent and well above November’s 2.89 percent. The slope rose 17 basis points (bp), staying above 300 bp, a full 46 bp above November’s 255 bp.

Projecting forward using past values of the spread and GDP growth suggests that real GDP will grow at about a 1.0 percent rate over the next year, the same projection as in November and December. Although the time horizons do not match exactly, this comes in on the more pessimistic side of other forecasts, although, like them, it does show moderate growth for the year.”

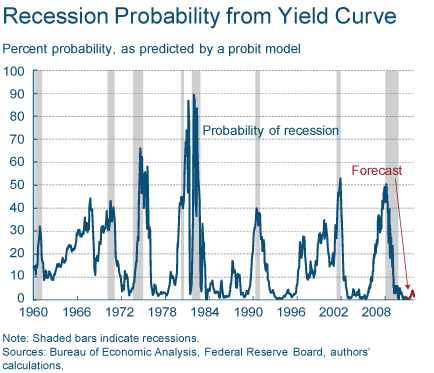

That’s clearly not good news given the high levels of current estimates, however, it’s also not a sign of imminent demise. Based on current readings there is almost no chance that a technical recession will be revisited in the coming year:

“Using the yield curve to predict whether or not the economy will be in recession in the future, we estimate that the expected chance of the economy being in a recession next January at 1.2 percent, a slight drop from December’s 1.5 percent and November’s 2.3 percent.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.