Few things will destroy a portfolio as quickly as politics. For instance, exactly one year ago Donald Trump won the Presidency and a lot of people assumed that the world was ending as a result. Even very smart people like Paul Krugman made dramatic claims such as the following:

“It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?

Frankly, I find it hard to care much, even though this is my specialty. The disaster for America and the world has so many aspects that the economic ramifications are way down my list of things to fear.

Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never.”

The total return of the S&P 500 since November 8, 2016 is 22%. So, not only did markets recover strongly over the next year, but they actually recovered within literal minutes of Trump’s win.

Now, I don’t mean to pick on Dr. Krugman. He’s since admitted his political bias error. But this is a glaring case of someone with Liberal politics who let that get in the way of objective analysis. Don’t get me wrong – I don’t love President Trump. I think his social policies are questionable at best and I am still a little stunned that the “grab them by the _____” comment didn’t sink him. But when it comes to economic analysis I’ve always been consistent with Trump – he’s economically friendly to a fault. Here’s what I said in real-time on election night:

My guess on Prez Trump:

1. Huge (stimulative) deficit.

2. Stock market rally (after some s/t instability).

3. Huge increase in inequality.— Cullen Roche (@cullenroche) November 9, 2016

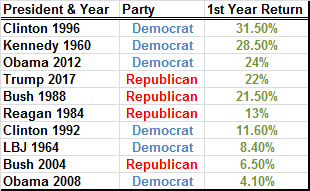

Not too far off. But of course, this happens on both sides. For instance, George W Bush didn’t cause the housing/banking crisis any more so than Barack Obama fixed it. Yet we constantly see both sides use these narratives to promote an agenda. But let’s dive a little deeper here and look at some actual data. The data below shows the top 10 bull markets in a President’s first 12 months since 1960 and the conclusion is pretty clear – the market doesn’t really care whether a Republican or Democrat is in office. The stock market can rally substantially regardless of the party.

But the point I am driving home is that when we allocate assets we need to separate our politics from our actions. Politicians make a living by making a lot of noise and making themselves appear more important than they really are. And a big part of their success in doing that is by capturing our emotional biases and twisting them to their favor. The reality is, while politicians are important, most of what they’re doing is not actually that important to the broader macro trends that are at work. For instance, year over year operating earnings are up 10% for the S&P 500. Does anyone really think that Donald Trump was the sole driver of that performance? Did Donald Trump make you get up and go to work everyday? You would have done it whether Trump won or not. And corporate earnings would be up 10% whether Trump won or not.

Think of it like a football game. You have the players on the field who are trying to maximize the points scored. And you have rule makers and referees who influence the way those points are scored. But the way some people talk about politics and investing you would think that it’s the referees and rule makers who determine all the outcomes there. As if they’re the ones blocking and tackling on every play. Referees matter of course. And they can make important determinations in the course of a game. But the overall performance of the game is due mostly to the players on the field whose actions on every down produce the results. Confusing politicians for driving stock performance is like confusing referees for the players on the field.

The bottom line is that corporate America is going to innovate and maximize profits regardless of whether there’s a Republican or a Democrat leading our government. While politicians are important we shouldn’t build portfolios based on our political biases. All that does is cloud our judgement and lead us to make irrational decisions driven by short-term political biases.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.