If I showed you the chart below and asked you where you should buy stocks and where you should sell stocks the answer would be obvious, right? You buy low and you sell high. Everyone knows that. Of course, it’s easier said than done, but we still know the right answer. And the reason why this is the right answer is because your risk adjusted returns are likely to be better when you buy low than when you buy high. Again, that’s obvious.

But what about government spending? Why don’t we think of it the same way? Actually, a lot of people do and they’re called “Keynesians”.¹ It’s no coincidence that Keynes was a pretty good investor and an advocate of countercyclical policies. He understood that government spending was likely to have a bigger multiplier when the economy was weak. That’s because government spending works in much in the same way that asset allocation works (or any spending in the economy). When you spend on assets at an attractive value they tend to perform better on a risk adjusted basis in the future.

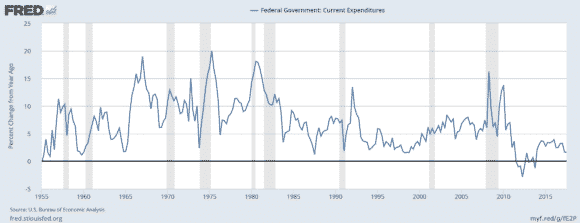

Now, the cool thing about government policy is that you can automate all of this so that the government spends more when the economy declines in value and spends less when the economy increases in value. In fact, that’s exactly how the US government works. Economists call this “automatic stabilizers”. Basically, the way it works is that government spending is designed to increase (because demand for government income will increase in downturns) when the economy weakens. At the same time tax revenues will automatically fall because the economy is slowing and private sector incomes are declining. It’s smart policy because it is the same basic premise as buying low and selling high. In essence, the government is spending more on its private sector when it becomes inexpensive and spending less on it when it becomes expensive. You can see how this actually works below. You’ll notice that the chart spikes right at the recessions because spending is automatically increasing:

Of course, real Keynesians advocate the same thing during strong economic times. When the economy booms the government should spend less on its (presumably) more expensive private sector. A budget surplus might be perfectly acceptable during booms. Again, this is just smart policy as it’s the equivalent of selling high.

The reason I bring this up is because the recent tax bill is essentially some version of the exact opposite. While most Conservatives were screaming about the risks of the deficit during 2008 and the post-crisis period they are now perfectly happy adding $1.5 trillion in debt after a 9 year economic boom. This isn’t countercyclical. If anything, it’s procyclical and it’s essentially a version of buying high after fearmongering that we shouldn’t buy low (in the aftermath of the crisis).

I’m not against tax cuts. Heck, I’ve been screaming for tax cuts for as long as I’ve written this website and I wanted the government to spend A LOT more when our economy was much weaker, but I think this is a good time to remind ourselves that smart government policy is not that much different from smart asset allocation. And if you’re bullish about increasing the government deficit after the economy has expanded for 9 years (after being bearish on government deficits during the bust) then you’re doing it all wrong.

¹ – Actual Keynesians (described accurately here) are different from the big bad socialist nightmare that has been depicted in certain fake news circles of the internet.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.