Do we indeed have a little housing recovery in the making? This would certainly bolster the no recession calls, but I am not getting overly optimistic. I still think we’re in for no recession, but I don’t think we’re headed back to the boom days in housing any time soon. Instead, the more likely scenario will involve the usual post-bubble stagnation for many years to come. That doesn’t mean there can’t be rallies and declines in the meantime. And according to Zillow’s latest housing report we’re seeing a bit of a rally:

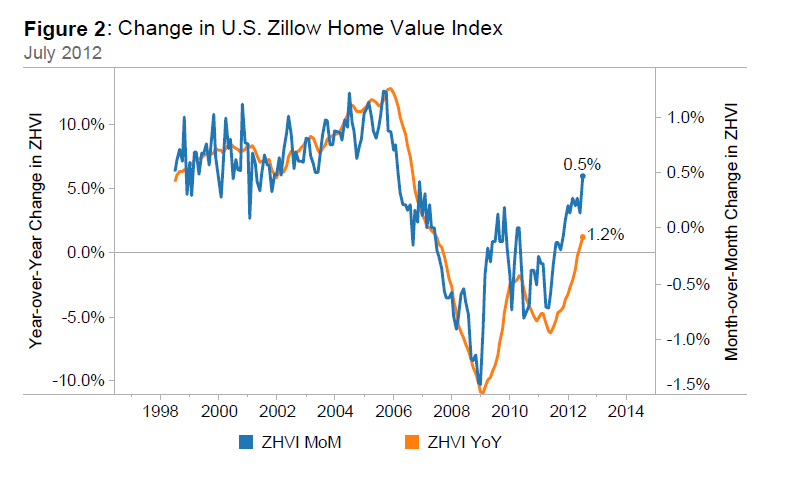

“Zillow’s July Real Estate Market Reports, released today, show that home values increased 0.5 percent to $151,600 from June to July (Figure 1), marking another month of healthy monthly appreciation. Compared to July 2011, home values are up by 1.2 percent (Figure 2), supported in many places by low for-sale inventory. Inventory shortages are being fueled by negative equity and a slowed distribution of REOs. According to Zillow’s first quarter Negative Equity Report, 31.4 percent of homeowners with a mortgage are underwater. A more in-depth analysis of the impact of negative equity on inventory shortages can be found here. In conjunction with rising home values, rents continued to rise in July, appreciating by 0.2 percent from June to July. On an annual basis, rents across the nation are up by 5.4 percent (Figure 3).”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.