Zillow is reporting a slowdown in recent house price appreciation after 9 months of gains. The decline was marginal, but consistent with a slow seasonal period and still difficult real estate conditions. We’re entering a much weaker seasonal period for housing so much of the recent exuberance over the “housing recovery” is likely to grow quiet. Zillow has more details:

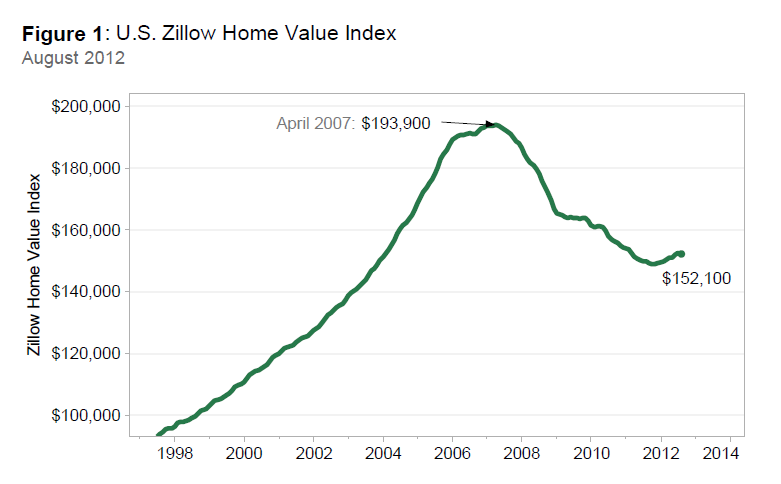

Zillow’s August Real Estate Market Reports, released today, show that home values decreased 0.1 percent to $152,100 from July to August (Figure 1). This is the first monthly decline after nine consecutive months of appreciation. This year has seen a turnaround in the housing market with sustained appreciation that, at times, has been very strong.

As we enter the back half of this year, we expect home values to see more volatility with a saw tooth pattern setting in characterized by months of home value declines interspersed with months of appreciation. Overall, the positive trend will hold as evidenced by home values being up by 1.7 percent (Figure 2) in August 2012 on a year-over-year basis.

Rents continued to rise in August, appreciating by 0.2 percent from July to August. On an annual basis, rents across the nation are up by 5.9 percent (Figure 3), indicating that demand, fueled by elevated foreclosure levels, is still outpacing investor-driven increases in rental supply.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.