A few thoughts on a crazy day in the markets…

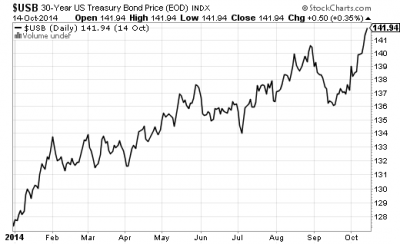

1) There’s hyperinflation in bond prices! Well, not really. But the 10 year T-note dipped below 2% for a brief while this morning and the 30 year just continues to rip higher. The 30 year zero coupon is up over 40% this year.

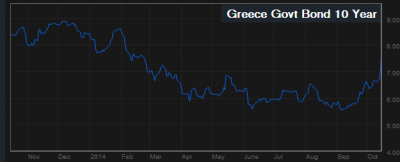

Of course, one place where yields aren’t falling is in Greece where the government is discussing an early exit from the backstop. There’s been a chronic illiquidity in Greek bonds and I still think the unraveling of Greece and Europe remains the biggest risk in this market. If there’s one thing that would lead to a huge amount of uncertainty it would be a restructuring of the EMU of some sort to make the monetary system more workable….

On a related note, I think Paul Krugman was way too harsh on Cliff Asness in his piece yesterday. We should be clear – Cliff has been wrong about inflation and he made that clear. What he hasn’t been wrong about is the fact that the Fed is potentially creating a huge amount of risk in the financial markets. One of the risks Asness has expressed over the years is the potential for market disequilibrium resulting from programs like QE which are designed to intentionally distort markets. I mean, the Fed itself has stated that the purpose of QE is to keep asset prices “higher than they otherwise would be”. That can be translated into “we will create false optimism about our ability to bolster asset prices”.

What we’ve seen in the last few weeks is a reversal in some of that “reach for yield” trade and we’re seeing lots of investors reverse their positions from high yield bonds and some Euro bonds because it’s become clear that the rewards are simply not worth the risks. Of course, this is precisely what Central Banks want. They want you to take more risk, but in a low growth world this becomes highly problematic and potentially creates more instability than stability. Krugman says Asness should stop criticizing Central Bankers about monetary policy, but maybe economists and Central Bankers should stop promoting actions that create market risks they clearly don’t understand….

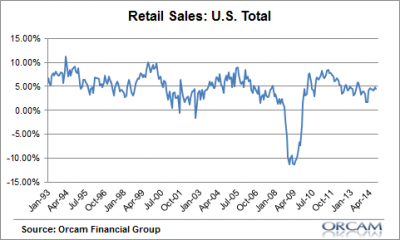

2) Retail sales were actually up 4.5% year over year. US economic data hasn’t been great in recent weeks, but the sell-off in stocks really has nothing to do with the US economy softening. It’s entirely based on the assumption that now, when the world sneezes, the US catches a cold. Historically, that’s been the other way around and given the continued moderate domestic strength of the US economy relative to the rest of the world I see no reason why this time is different.

3) Vanguard’s Balanced Index Fund is underperforming in 2014…. Yes, I am still on that whole “passive” vs “active” kick. Get used to it because I think this is an incredibly important thing to understand. Anyhow, I think it’s pretty interesting to see how some “passive” funds are performing relative the Global Financial Asset Portfolio (GFAP) which is the one true global benchmark.

While stocks got kicked in the teeth today bonds actually did pretty well. We all know how most asset allocation models via Modern Portfolio Theory work – you almost always end up with a stock heavy portfolio even though the GFAP is bond heavy. So, ironically, what we get with most “passive” indexers is an excuse (such as “factor tilting” or “risk tolerance” or timeframe) to overweight stocks and deviate from the global cap weighted index. There’s really nothing “passive” about this at all. It’s someone misunderstanding the macro cap weighted GFAP and then making a flimsy excuse to deviate from the global cap weighting and buy stocks because they have tended to generate better nominal returns than other assets.

Anyhow, the GFAP is up roughly 5% year to date while a “passive” 60/40, which has become all the rage in the investment world, is up a measly 1.2%. The ironic thing is that the people who own a 60/40 really buy into the idea that they’re being “passive” even though they’ve actively chosen to deviate from the GFAP. And all the while they’re underperforming by a wide margin on a nominal and risk adjusted basis this year. As I showed here, “passive index” advocates regularly perform studies on stock pickers without noting that the indices they pick also tend to underperform relative to the global aggregate. The irony is so thick here that it makes me question the macro understanding of anyone who advocates “passive indexing”….

It just goes to show how misguided some of the Wall Street sales lingo can be. “Passive indexing” is just another clever sales pitch for an approach that actively picks an asset allocation and differentiates itself by charging a low fee all the while strawmanning stock pickers to death. I’m all for low fees. But I’m vehemently against deceptive sales practices that lead people to believe they’re engaged in something that they’re not. The reality is that most passive indexers are just as bad at picking assets as the stock pickers they regularly demonize.

You can read about the Global Financial Asset Portfolio and the general methodology here and here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.