* This is part 1 of this post. Please refer to this link for part 2.

If there was such a thing as an indexing purist that person would simply buy all of the outstanding available financial assets in the world and call it quits. In other words, they would take what the market gives them rather than trying to make active predictions about which parts of the financial asset world will perform better than other parts. Of course, that’s not how most of us invest. Even the so-called “passive” indexers are engaged in a form of active index picking which generally results in a portfolio that is overweight stocks. But what if you could be a purist? What if you wanted to just accept what the market gives you? And how would that portfolio perform in general?

Constructing the Portfolio

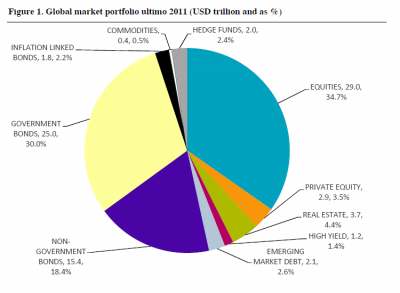

As I’ve noted previously, the global asset portfolio as comprised by this paper, is a pretty good starting point. It looks like this as of 2011:

I have a few issues with the portfolio:

- We should be focusing on FINANCIAL assets as opposed to holding every asset in the world. Clearly, an index of all the world’s assets is impossible to come even close to replicating so let’s stick to financial assets entirely. Because of this focus on financial assets we are eliminating any exposure to non-financial assets like real commodities.

- In addition, this can be justified based on the understanding that commodities are mainly cost inputs in the capital structure that generate no real return in our financial portfolio over long periods of time (see here for more).

- To reduce repetitive allocations we will eliminate the “hedge fund” component and instead allocate this portion in accordance with the HFRI Equal Weight Index.

- Private equity is just equity on the primary markets so for simplicity of replication and practical implementation let’s just roll that into equity.

- Cash and all cash equivalents are not being included in this analysis, but it should be acknowledged that cash is an ever present asset class in any realistic portfolio that will require management (see here for more).

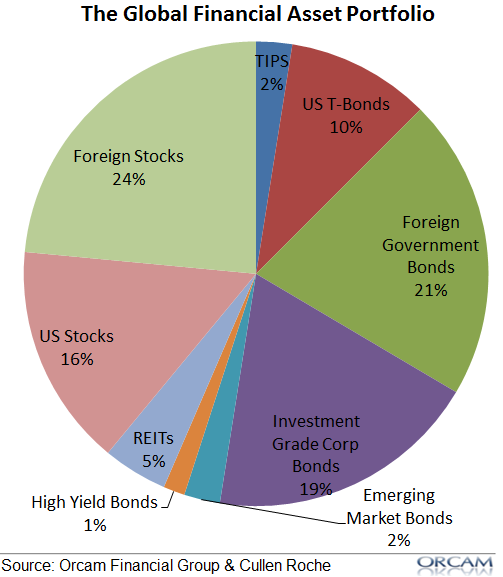

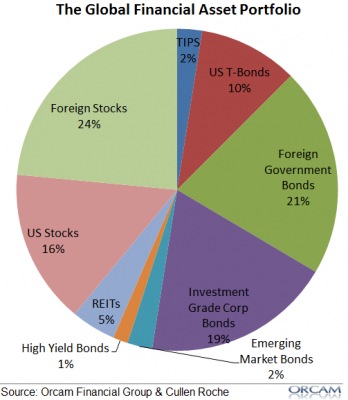

When we rearrange the portfolio based on the above assumptions we get a portfolio that looks roughly like this:

That’s basically a 55% bonds, 40% stocks, 5% REITs portfolio, which is pretty interesting because the common thinking on indexing is usually stock focused. Keep in mind there are lots of different types of instruments within each of these components (like MBS, municipal bonds, high yield, etc). But this is a good approximation of what the Global Financial Asset Portfolio might look like. And it’s easily replicated through available funds.

Portfolio performance

Because of the unavailability of some asset classes we can only backtest this portfolio to 1985. The numbers are pretty impressive though:

Compound Annual Growth Rate (CAGR): 8.7%

Standard Deviation: 6.89

Sharpe Ratio: 0.73

Sortino Ratio: 1.32

Correlation to International Markets: 0.54

For perspective, a 60/40 stock/bond portfolio over this period generates the following:

Compound Annual Growth Rate (CAGR): 9.5%

Standard Deviation: 9.51

Sharpe Ratio: 0.5

Sortino Ratio: 0.77

Correlation to International Markets: 0.95

In other words, the stock heavy 60/40 portfolio is just leveraging the equity component of the GFAP which generates a better nominal return, but a worse risk adjusted return. An indexing purist wouldn’t be shocked by that if they were an advocate of the GFAP as their ultimate benchmark. Of course, most indexers are actually “asset pickers” who engage in a degree of asset class forecasting or factor based asset allocation strategies. But just as with anything involving dynamic markets there is a certain degree of forecasting, guesswork and imprecision involved. Given the limitations of this research there are some important caveats and further details that will require another post in the coming days.

In part 2 I’ll tackle the most important question:

“Is the Global Financial Asset Portfolio the perfect indexing strategy?”

Sources:

1. Global Market Capitalizations, World Federation of Exchanges, July 2014.

2. The Global Multi-Asset Market Portfolio, Ronald Q. Doeswijk, Trevin W. Lam & Laurens Swinkels, January 2014.

Related:

- Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance

- Debunking some Common Investment Myths

- We Are All “Active” Investors

- Most Index Funds are Macro Funds

- Putting the “Underperformance” of Active Managers in Perspective

- Of Course 80% of Active Managers Underperform the Market!

- There’s no Such Thing as “Forecast Free” Investing

- The Importance of Understanding Your Implicit and Explicit Forecasts

- The Importance of Understanding Your General Portfolio Framework

- The Contradiction of “Passive” Index Fund Investing

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.