Paul Krugman is unhappy with me nipping at his heels about banking. But I think this is important and crucial to Dr. Krugman’s idea that the “synthesis” has been “lost” so I am taking hold of that ankle once again and shaking my head as vigorously as I can. Anyhow, he says his model hasn’t been wrong and that he’s just oversimplifying the way banking works while remaining totally consistent with Tobin-Brainard & Diamond-Dybvig. I don’t see it that way. Let me explain.

1) First of all, I think Dr. Krugman might have me confused with some other people who think they’ve “discovered the hidden secrets of the monetary universe”. Lots of people confuse MMT for being the same as Post-Keynesian Economics, but that’s not quite right.

Much more importantly, I think it’s crucial to embrace the fact that “generations of economists” probably have misunderstood how the monetary machine works to some degree or at least don’t have views that perfectly apply to today’s system. After all, the monetary system is not a stagnant system. It is dynamic and evolving. The system in place in 1900 is VERY different than the system we have today. That requires constant upkeep and tweaking of core concepts and models. Not to mention, economics as a whole is a rather new development. I think it would be silly to assume that we’ve reached “peak economics” in terms of our understandings when economics as a discipline has only existed for a few generations. We’re very much in the early stages of developing our understandings of these things despite the many great minds that have researched this subject matter.

2) The two papers Dr. Krugman cites were written in 1963 and 1983 long before QE with IOR was implemented and during a time when policy was in fact very different. The way monetary policy is enacted today is dramatically different than it was in 1963. More importantly, the way policy impacts banking is dramatically different than it was in 1963. For instance, the Tobin paper discusses in detail how reserve requirements are used as a policy tool to control reserve balances and influence the way banks lend. But that view is entirely inapplicable to a world where the Fed is paying interest on reserves when their balance sheet has been expanded. In other words, the cost of funding (what is traditionally thought of as the Fed Funds Rate) has become the Interest on Reserves Rate. I.e., the IOR is a de facto FFR. As point 1 expresses, you must account for substantial changes in the way the system is designed before you conclude that someone’s 50 year old views are a good stepping stone for understanding the current system and current policies. I am fairly certain that James Tobin would agree that paying IOR changes the way we should view the system.

3) What I was really saying in my initial post was basically an expansion of this thinking – that in order to understand why QE didn’t cause high inflation you need to view the monetary system differently. And the IS/LM model wasn’t going to get you to the right conclusion because it doesn’t actually apply (rather, it might get you there, but not for the right reasons). Stick with me here if you’re a non-economist. This will be a little wonky, but you’ll get it.

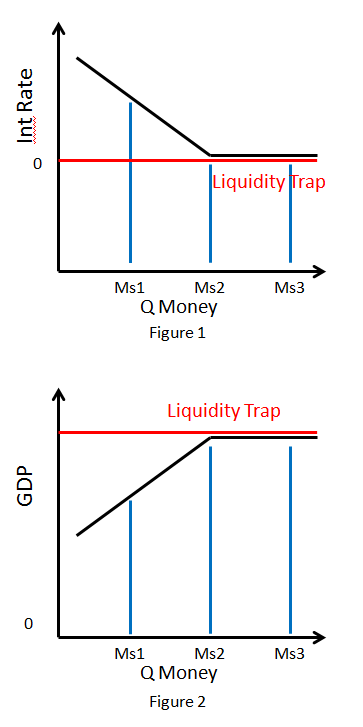

If you look at the diagrams below we’ll basically see the model of the world as Dr. Krugman views it at present where we’re in the “liquidity trap”. Normally, when the Fed increases the money supply (pushes money supply 1 to money supply 2 – the blue bars) the interest rate goes down. Normally, if we reduce the real interest rate then investment/saving increases as GDP increases (see figure 2). But when you’re at the zero lower bound where interest rates can’t go down any further then the Fed hits a wall and “printing” more money (going to Ms3) won’t increase GDP.

There’s a few problems with using this model. First of all, the Fed isn’t determining the interest rate by altering the money supply. The reason they’re paying interest on reserves is specifically so that they can control interest rates without having to worry about the amount of reserves in the system. In other words, unlike the James Tobin world, interest on reserves is a de facto Fed Funds Rate. So the quantity of money in the reserve system is not the determining factor of the overnight interest rate. If the Fed wants to raise interest rates it will not look at the chart above and shift Ms3 back to Ms1. IT DOESN’T HAVE TO! The Fed will simply raise the interest rate on reserves which will stop banks from trying to lend reserves to one another (because lending reserves to one another – the only time they actually do lend reserves – would drive the rate down).

In other words, the charts above, which are quantity centric views of the monetary system don’t apply with IOR because the Fed isn’t targeting quantity, they’re targeting price! So the charts above tells us a lot less than Dr. Krugman’s model claims because the quantity of money isn’t the determining factor of the interest rate.*

Second, the main point of my previous post was to highlight the fact that banks don’t make lending decisions based on the amount of reserves they hold. And yes, James Tobin most certainly understood this point. In “Commercial Banks as Creators of Money” he wrote:

“An individual bank is not constrained by any fixed quantum of reserves. It can obtain additional reserves to meet requirements by borrowing from the Federal Reserve, by buying ‘Federal Funds’ from other banks, or by selling or ‘running off’ short-term securities.”

In other words, banks lend first and find reserves LATER if they must. This is in stark contrast to what Paul Krugman writes 50 years later:

“First of all, any individual bank does, in fact, have to lend out the money it receives in deposits. Bank loan officers can’t just issue checks out of thin air; like employees of any financial intermediary, they must buy assets with funds they have on hand. “

Banks are the primary creators of money in our monetary system and as Tobin correctly notes, they can lend first and find reserves after the fact. But this starts on the demand side, not the supply side. In other words, banks lend when creditworthy customers have demand for loans and not just when creditworthy banks have access to supply.

Now, it’s important to understand that most of what the Fed actually does is just asset swaps to help try to hit an interest rate target or try to influence the private sector portfolio holdings (QE is not actual “money printing” in any real meaningful sense because it’s just an asset swap). This is why it’s crucial to understand precisely what QE does. QE swaps one privately held asset for another. When QE is performed with a bank the bank ends up holding more reserves and fewer t-bonds. In the old textbook model the government has increased the “money supply”, interest rates will fall and banks will lend more as investment increases and banks “multiply” their reserves. But reserves are held in the interbank market and don’t influence the amount of lending banks make (per Tobin). So increasing the level of reserves is not analogous to firing dollar bills out the front of the Federal Reserve. And contrary to popular mythology, the Fed is not the actual distributor of cash notes so that’s a diversion in all of this. The quantity of cash notes held by the public is determined by depositor demand and the US Treasury ultimately will fill orders from regional Fed banks to meet bank customer demand. The Fed doesn’t push cash out of its doors.

So, QE and more reserves didn’t cause rates to go down because we know the Fed can control rates without having to worry about the quantity of reserves. And we know that the quantity of reserves didn’t cause the money supply to increase in any meaningful sense because it doesn’t result in more lending and amounts to little more than an asset swap. So the IS/LM model, which is quantity theory based, didn’t tell us as much as one might presume. So there had to be something else going on there. Of course, I’ve argued that the demand for credit was low because households were de-leveraging. And that would explain why borrowing has been stagnant and economic growth has been rather anemic. In other words, the REAL transmission mechanism to increase private sector money (inside money or bank money) was broken! And we didn’t have to understand the IS/LM model to understand why QE wouldn’t cause high inflation.

There’s a more interesting discussion to be had here and one I hope Dr. Krugman will entertain. But I will discuss this in detail tomorrow because I fear if you’ve made it this far your eyes are starting to get awfully heavy and my ankle biting is losing its efficacy…..

* We can quibble over QE’s impact on long rates, but I’ll take the SF Fed’s word for it that it’s “negligible”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.