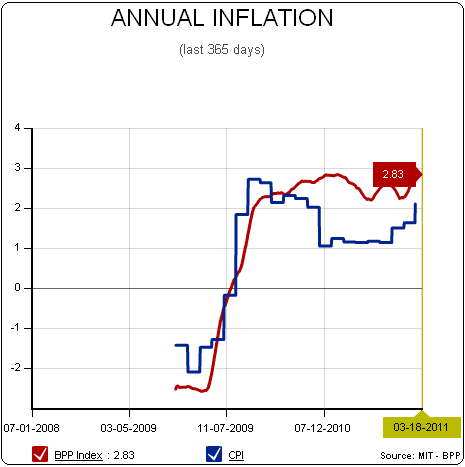

What happens when commodity prices rise by 30% in just 6 months and you have an environment with high unemployment, stagnant wages, and generally weak end demand? According to the Billion Prices Project you get a modest year over year increase in inflation rates. According to the most recent real-time reading the BPP is up 2.83% versus last year. This data does not include energy prices or housing costs. While this increase is likely higher than some are comfortable with I think it is still consistent with an environment in which the Fed will remain concerned about downside economic risks.

At the beginning of 2011 I said headline CPI was likely to hit 2.5% this year – higher than in previous years, but still below the historical average of 3.5%. With headline CPI now rising again (1.7%) and commodities surging it wouldn’t surprise me if we hit that 2.5% rate by this summer, however, these price increases are materially impacted by QE2 and seasonality in energy prices. With QE2 ending June 30th and oil prices tending to rally into the July 4th weekend we should expect upward risks to commodity prices.

We have seen this movie before

But we’ve seen this movie before. Ben Bernanke has 2008 in the front of his mind. House prices are falling again, the consumer is still de-leveraging and the potential for Japan style deflation still has Mr. Bernanke deeply concerned. And I don’t think a surge in commodity prices is going to sway him. As we learned in 2008, you can have surging commodity prices, no sustained inflationary impact and a deflationary collapse only months later.

I would be surprised if the commodity price increases are sustained without a substantial increase in economic activity (or a catastrophic supply disruption in oil in the Middle East which likely drives inflation very high and then drives the global economy into recession). For now, the problem remains one of end demand and end demand remains weak.

What is really causing the inflation pressure?

What we can confirm is that the US money supply is not exploding (contrary to popular mythology). We can also confirm that China’s money supply IS exploding. Combine this with the modest economic recovery, speculative effects of QE2, the seasonal impacts of energy and the unrest in the Middle East and you have all the ingredients for a modest increase in inflation. I would argue, however, that the recovery remains far too anemic to generate sustainable above average levels of inflation. And this is likely to keep the Fed on hold for the foreseeable future.

Fed, meet rock and hard place.

With the CPI coming in at just 1.7% (and independent measures still below historical averages) the Fed is likely to continue playing it on the safe side with very accommodative policies. They are going to be certain of sustained economic recovery before making a move on rates. And that likely means we need to see several 200K+ monthly employment reports before the Fed makes a move on rates. Unfortunately for the Fed they have no control over the balance sheet recession and in fact can only contribute to the current environment by forcing a re-leveraging or speculative fervor (neither of which are cures for our current ills). While Fed policy doesn’t pose any risk of high inflation or hyperinflation it does pose substantial risk to economic instability by encouraging the same actions that got us into this crisis to begin with. Fed, meet rock and hard place.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.