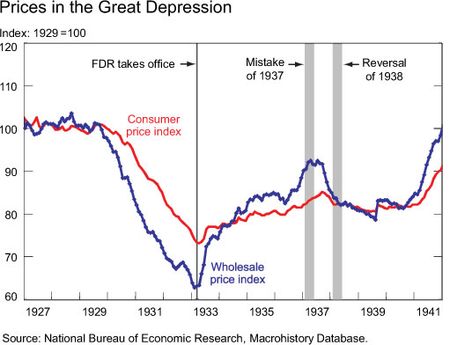

The NY Fed has a very good piece on their blog this morning titled “Commodity Prices and the Mistake of 1937: Would Modern Economists Make the Same Mistake?” It helps shed some light on the current economic environment and shows why investors should not be too quick to assume that high inflation will result from the commodity price increases. They say:

“In 1937, on the eve of a major policy mistake, U.S. economic conditions were surprisingly similar to those in the nation today. Consider, for example, the following summary of economic conditions: (1) Signs indicate that the recession is finally over. (2) Short-term interest rates have been close to zero for years but are now expected to rise. (3) Some are concerned about excessive inflation. (4) Inflation concerns are partly driven by a large expansion in the monetary base in recent years and by banks’ massive holding of excess reserves. (5) Furthermore, some are worried that the recent rally in commodity prices threatens to ignite an inflation spiral.”

They go on to show how economists now focus on headline CPI and not the volatile parts that include commodity prices. This helps “smooth” their outlook and avoid jumping to conclusions. Interestingly, however, the current Fed may have made the exact opposite mistake in 2010.

In August 2010 the Fed panicked over the Euro crisis and a sharp spike in jobless claims that coincided with a few weak economic reports. At the time, prices were in a strong disinflationary trend. And they responded. QE2 was the result. The NY Fed described the 1937 period as a failed response to the rise in commodity prices at the time – in effect, they tightened when they shouldn’t have. You can see the rise in commodities in the following chart:

Ironically, QE2 preceded the most recent surge in commodity prices. And as the BOJ concluded, the Fed and speculation has likely contributed to this rise in commodity prices. As I’ve stated before, this sort of misguided intervention can have a destabilizing effect on the economy. So, interestingly, it’s not the response to the commodity price spike that may have been the policy error this time around – it was the misguided response to price declines, resulting in QE2 that appears to have created the current air pocket in the global economy….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.