In his Financial Instability Hypothesis, Hyman Minsky described how a process of Ponzi finance can result in increased financial instability:

“over a protracted period of good times, capitalist economies tend to move from a financial structuredominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently,units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.”

The recent downturn in commodities is interesting for several reasons. None more so than the fact that investors are now beginning to notice that the price increases have been driven in large part by speculation generated by QE2. Regular readers are well aware of this fact, however, much of the investment world has been basing their commodity thesis on booming global economies, myths of money printing, misguided fears of hyperinflation and not the primary driver – financialization.

As the Bank Of Japan recently pointed out, there has been a substantial speculative premium in many commodities. In many ways this is reminiscent of 2008 when the Fed was seen as creating inflation, however, what lurked beneath the surface was disastrous deflation. While this environment isn’t nearly as susceptible to collapse, we are still at risk of a major dislocation due to the Fed’s severely misguided policy of QE2 and the market’s dramatic misinterpretation of it.

Financialization of markets

FT Alphaville has done a fantastic job in recent weeks and months covering some of the dislocations and connecting the dots. In a recent story they cited the continuing use of copper as a financial tool:

Veteran copper market watcher Simon Hunt of Simon Hunt Strategic Services believes the dynamics are the result of a longstanding misunderstanding by the industry of the difference demand and consumption. Consumption, being the actual indicator of real demand.

As he noted in a research report earlier this week:

In other words, copper price movements have been quite unrelated to actual business. Demand, in most analysts’ calculations, is confused with consumption. It is the aspect of demand that is material acquired by financial institutions, which has been the principal driver of price. Last week‟s correction was part of the game being played out. At between $9000 and $10,000 there was difficulty in finding new investment buyers; lower prices are needed for the game to continue.

And if that is true, there could be yet another — potentially more sizeable — correction yet.

This is just one obvious effect of this sort of mass financialization of our economies. Other obvious examples include the Chinese farmers who are hoarding cotton due to Fed money printing fears. Other examples, such as the continuing surge in oil prices despite tepid fundamentals, are less obvious. And every once in a while, we can see the financialization impact with our own two eyes as we were able to just a few weeks ago when the Fed announced their continued easy policy stance and every commodity went racing higher in a speculative frenzy in a matter of minutes.

Why is this problematic?

The risk the Fed creates, when they intervene in markets in this manner, is that they generate the risk of a major dislocation in the markets that feeds over into the real economy. When you create an implicit guarantee and speculators take you at your word they are more likely to generate a destabilizing pricing environment. This was recently seen in silver prices where the inflation bandwagon has run full speed off the tracks and now real silver producers are being forced to deal in a market that is entirely unstable and unpredictable.

When the Fed intervened via QE2 they were not really altering the economy in any meaningful way. This asset swap did not change net financial assets. It did not create more money. It did not result in any stimulus. All it really did was bolster asset prices via the psychological routes. In essence, the Fed was trying to create nominal wealth with the hope that this would translate into real wealth. This can all be proven now by looking at lending data, falling GDP, the stagnant money supply, and exploding margin debt at the NYSE. So, the Fed goes into the market and tells everyone to buy risk assets. Don’t fight the Fed, right? And they didn’t. But focusing on nominal wealth creates the risk that the cart will come before the horse, ie, prices will substantially outpace fundamentals and create a destabilizing market environment.

How does this play out?

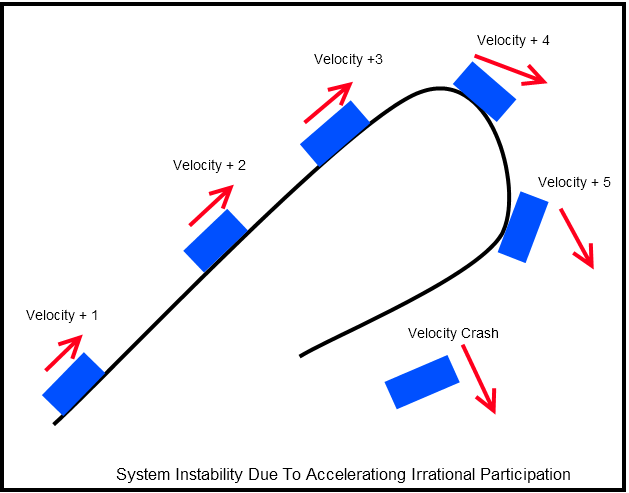

We can visualize this economic journey by envisioning a car on a moderately hilly road. This is comparable to the natural course of the business cycle. There will be ebbs and flows, ups and downs. Markets are irrational as they are. But if a powerful entity is able to intervene in this course of events it’s not unreasonable to expect that the cycle could experience increased volatility as its forces take an unnatural form by distorting the underlying economic reality. In an attempt to generate stability the entity could theoretically create increasing instability. In the case of the Federal Reserve and QE2 this involves focusing on nominal prices as opposed to policy implementation that benefits the real economy. By creating a price increase in nominal terms we risk exaggeration in the pricing mechanism. As we experienced in 2008 that can be devastating as prices surge and then collapse and fear captures the real economy in the aftermath. The following figure shows how such environments might be altered over time to experience increased volatility and business cycle disruption:

What has occurred in recent months is exactly what Dr. Bernanke desired. If we change the perspective on our car on the road we can better visualize how this environment plays out. As our car picks up speed it continues down the road with increasing velocity. Slowly, but surely the participants decide the car can handle more participants and increased velocity that will generate increased pleasure (market gains due to increased speculative behavior). Eventually, the car enters a tight turn (or a bump in the economy). If the speed is greater than that of the natural forces exerted against the car (price disequilibrium resulting in severe instability) then the car will leave the road and enter a period of instability as it veers into uncommon grounds.

This is exactly what occurs when markets enter a period of disequilibrium. In my piece on the silver bubble a few weeks ago I described the four primary components of this disequilibrium:

- Strong fundamental underpinnings. Bubbles do not merely appear out of nowhere. Bubbles grow over a period of time based on strong fundamental underpinnings. There is always a very good economic reasoning behind bubbles. This feeds into the rationalization of its existence and justifies a “it’s different this time” mentality that later occurs.

- Ponzi builds. A naturally occurring ponzi process begins. As a recency bias builds (the tendency to overweight recent events and ignore historical facts) the system begins to exhibit herding behavior as more and more investors get in on “the only game in town”. This becomes amplified by the media, those with a vested interest in this particular market, those who “throw in the towel” after wrongly betting against the trend, etc.

- Illusion of stability within disequilibrium. The illusion of control increases as investors become increasingly confident in the market. They increase their bets, increase price targets, etc. Investors begin to convince themselves that it is “different this time”. All of this is occurring as the system grows increasingly unstable. I like to think of it like a spinning top. When you initially throw a top into a tight spin there is a distinct order in its movements. They are predictable and stable. But as the top loses momentum it begins to spin uncontrollably. The system becomes unstable, unpredictable and ultimately breaks down. Bubbles work within the same sort of illusion. What appears like a stable and self sustaining system is in fact increasingly unstable and entering an inevitable disequilibrium that breaks down.

- Systemic collapse. All bubbles collapse. It is never “different this time”. As this prior herding effect begins to breakdown there is a flood for the exits as the herd reverses its controlled march into a panicked stampede. The gig is up. Collapse ensues.

In the case of our car, it involves a moderate velocity which is slowly increased as the riders become increasingly confident in the car’s performance and increased pleasure being generated from the ride. As the car enters its first portion of the turn (or bump in the economy) it is tested, but maintains stability. This stability actually increases the instability as the ponzi builds and the riders become even more confident in the car’s performance. In the case of the Fed, the riders need only a small vote of confidence to put the pedal to the metal. This leads to stage three in the disequilibrium where everyone now believes it is different this time. There is no chance the car can slide off the road or threaten its riders. And of course, that exact event occurs and the system is thrown into chaos.

In asset markets like silver the car gained so much momentum that it actually created a destabilizing force. In the ensuing collapse we run the risk that the real economy is impacted through the fear and uncertainty that is involved in the ensuing market collapse. The collapse in silver prices could materially impact the way real producers and consumers utilize the metal. And that collapse can be directly attributed to the various destabilizing forces that helped it to build the momentum that led to the surge in prices and ultimately a period of instability.

This is the risk the Fed has created multiple times over the course of the last 20 years and it is the same risk I believe they have created today. Will it result in a full blown commodity collapse and a highly destabilized global economic event? I don’t know and neither does anyone else. But as a risk manager I have to accept the fact that the risk now appears elevated. But perhaps more importantly, the Central Bank of the United States should recognize the destabilizing nature of its misguided policies. In the future, it would be my hope that the Fed focus more on the real economy and a bit less on nominal prices. Putting the cart before the horse can be highly destabilizing and can result in increased systemic instability. As we sit with 9% unemployment well into an economic “recovery” we should all be aware of how damaging that instability can be….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.