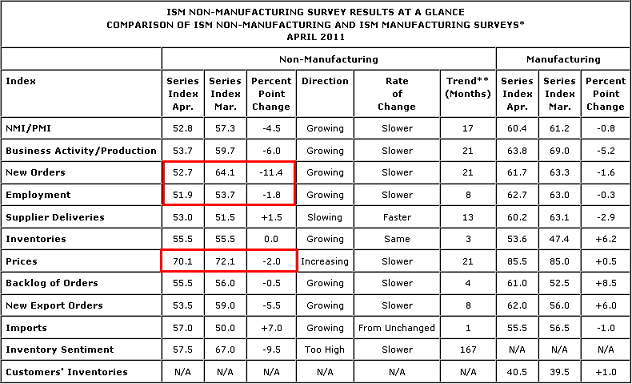

This morning’s ISM Services report missed estimates substantially. Headline came in at 52.8 vs expectations of 57. The underlying data was even worse. New orders tanked 11.4 points to 52.7. Unemployment fell to 51.9 from 53.7. Meanwhile, prices, though falling, remain at very high levels.

The answers from respondents nicely summarizes the environment:

- “Business conditions [remain] unchanged. No supply impact from the Japan earthquake/tsunami, but continue to track with the supply base.” (Management of Companies & Support Services)

- “Revenues are picking up slowly, but the growth is positive as compared to last month and the same month last year.” (Real Estate, Rental & Leasing)

- “Looking forward with reserved caution. Cost of goods by this fall are a big worry.” (Accommodation & Food Services)

- “Continuing economic uncertainty will curtail or delay project spending for the immediate future.” (Educational Services)

- “Fuel prices continue to be challenging and in addition to shipping, are influencing the cost of materials.” (Public Administration)

- “We are seeing price increases in many areas, and the lead times are stretching out. Our business activities are improving at a moderate rate.” (Wholesale Trade)

So what we have is an economy that remains very weak where job’s growth is still muddling along and rising prices are hurting corporate profits. Those who are finding solace in the idea that this weak report confirms QE3 might reconsider. If anything, this report only confirms my findings that QE has had no meaningful positive impact on the economy. In fact, you could easily argue that the cost increases due to commodity price speculation are the only meaningful result of QE2 and are having a negative impact on the overall economy.

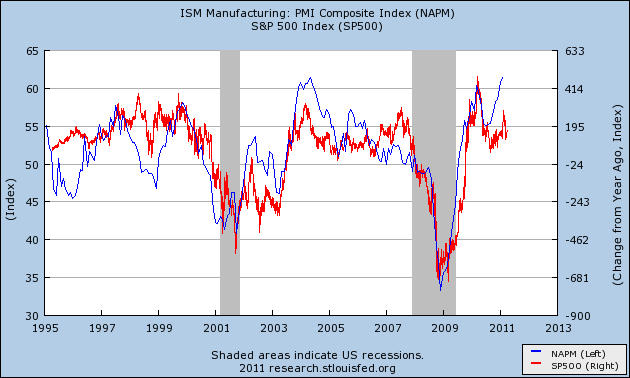

What does it all mean? Well, the good news is that the index is still expanding. Although 52.8 is a big miss it is still an expansion. So it’s not yet time to panic. It is worth noting, however, that lower ISM reports have correlated very highly with equity returns (see here for more). Although the ISM Manufacturing report remains robust at 60.4 it would be surprising to see the two indexes diverge permanently. Because these are diffusion indexes we can likely expect the ISM Manufacturing report to decline in the coming months. And as I discussed last month, that could be a significant headwind for equities – even though it doesn’t point to economic doom.

For now, I still believe the US economy is strong enough to maintain meager growth. The risks still are exogenous – primarily foreign related as China eases their economy and Europe remains mired in a debt crisis. Our balance sheet recession is very much alive, however, the government has done just enough to offset the negative impacts. Unfortunately, the Fed appears to have added another risk to the scenario in commodity prices. We should all hope that the price boom in commodities does not lead to a price collapse. If anything, all of this only confirms the thinking that “hedge in May” is a good idea.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.