I’ve discussed the concept of how budget deficits can lead to higher corporate profits in the past. I am not the only one or the first one to do this of course. Anyone who has studied some advanced economics is familiar with Michael Kalecki’s profits equation. It’s been used widely in recent years given the budget deficit situation in the USA and the record profit situation. James Montier of GMO used it earlier this year as has John Hussman in his work.

So I was confused when I saw this piece at Zero Hedge which tried to imply that there is no connection between budget deficits and corporate profits. Of course, plucking the case of Japan out of thin air and making sweeping conclusions doesn’t invalidate the work of Kalecki, Montier or anyone else, but I think ZH has a point. I just don’t think they’re articulating it the way they should.

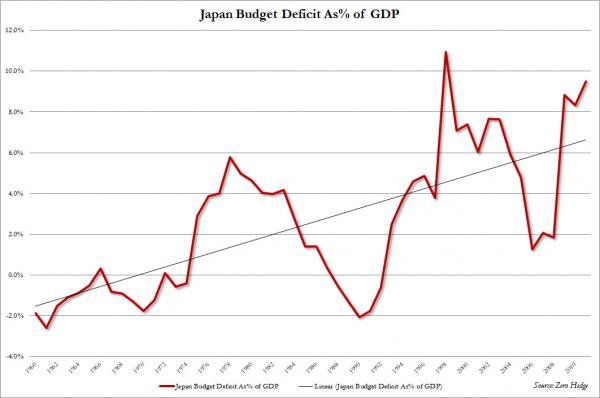

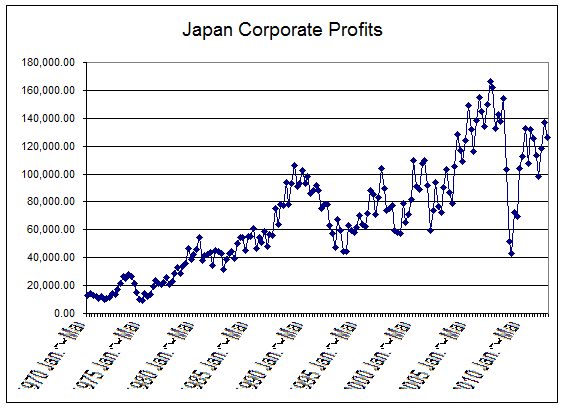

First of all, there is most certainly a high correlation between Japanese corporate profits and their budget deficits. The following images (the first from ZH and the second from the Ministry of Finance) make this crystal clear:

The fact that budget deficits can lead to high corporate profits is disconcerting to some people. And for obvious reasons. It might lead some people to conclude that the government has a magic money tree that they can pluck from which will just make everything all better any time the economy looks like it’s in a bind. Of course, the equation behind living standards is not as simple as that. What this relationship tells us is simply that as the government spends more the non-government’s income increases. This is an accounting identity. If the government buys $100MM worth of jets from Lockheed Martin then a whole bunch of guys and gals living in Fairfax County, VA have swollen bank accounts as a result. That’s all easy to understand. But what it doesn’t tell us is anything about the quality of the government’s spending or the impact it has on the overall quality of output.

If the government turns on the spending spigot there is no guarantee that the private sector will continue to create goods and services that are of high quality that will increase our overall living standards. Yes, the government could buy every single piece of plastic that Apple Corporation cranks out of their Chinese warehouses and it might not matter one bit to our living standards.

We had this debate with MMT when we discussed the importance of S = I + (S-I) in the early days of forming Monetary Realism (MR). Saying that the government’s deficit is the non-government’s surplus is only a slice of the overall story and really tells us very little about the overall health of the economy. It’s more important to understand how domestic Investment plays the primary role in how increases in living standards are generated.

So no, when I say that the government’s budget deficits have led to higher corporate profits I am certainly not saying that this automatically means the nation is better off. It just means I have read some Kalecki and understand accounting identities. But accounting identities require more in-depth analysis than merely saying “my spending is your income – it’s an accounting identity!” They require understanding the make-up that how that income and spending ultimately influences living standards. And anyone who thinks that government spending leads to automatic increases in living standards has completely missed the point here….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.