This meshes nicely with my recent discussions about the importance of understanding the global financial asset portfolio for the purposes of portfolio construction (see here and here). I’ve emphasized that the only truly “passive” portfolio is the portfolio of total outstanding financial assets. Of course, that portfolio is constantly changing and replicating it is nearly impossible. Therefore, we all have to actively choose to deviate from the global cap weighted portfolio and make active decisions about how to allocate our portfolios. Owning the “market portfolio” just isn’t a realistic option.

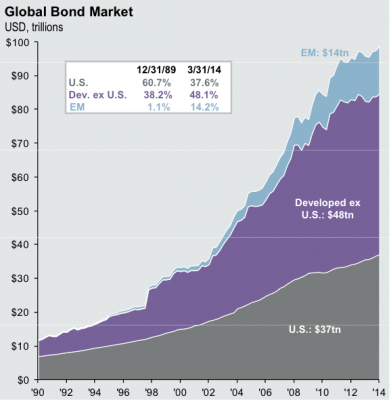

To emphasize this point just look at how much the bond market has changed in recent years.  If you wanted to replicate the global bond market in 1989 you wouldn’t have been terribly far off if you just owned the US bond market (though that would have only gotten you 60% of the total market). But that has completely shifted in the last 30 years as the US has fallen to just 38% of outstanding global bonds and the developed markets ex USA and emerging markets have jumped to 62%. In other words, if you wanted to just invest “passively” you’d now own a much larger slice of bonds outside of the USA than you probably do.

If you wanted to replicate the global bond market in 1989 you wouldn’t have been terribly far off if you just owned the US bond market (though that would have only gotten you 60% of the total market). But that has completely shifted in the last 30 years as the US has fallen to just 38% of outstanding global bonds and the developed markets ex USA and emerging markets have jumped to 62%. In other words, if you wanted to just invest “passively” you’d now own a much larger slice of bonds outside of the USA than you probably do.

This is even more interesting when we look at the stock market relative to the bond market because the structure of interest rates has caused an equally substantial flip. In the early 80’s the global market cap weighting of outstanding stocks was about 60%, but today that has fallen to just 45%. As I’ve noted, the outstanding global cap weighted portfolio had you positioned to be underweight bonds before the greatest bull market in bonds ever – talk about a failure of Modern Portfolio Theory! And it now has you overweight bonds relative to stocks at the time when bonds are almost certain to deliver weak future returns.

It all goes to show what should be obvious – at the macro level the market actually isn’t all the “efficient”. It’s just an ex-post snapshot of recent trends. And more importantly, it’s incredibly dynamic and constantly shifting. A “static” portfolio approach might serve you fine, but it’s doubtful that it will be optimal over the course of the business cycle as risks and markets evolve.

Source: JP Morgan Q4 Guide

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.