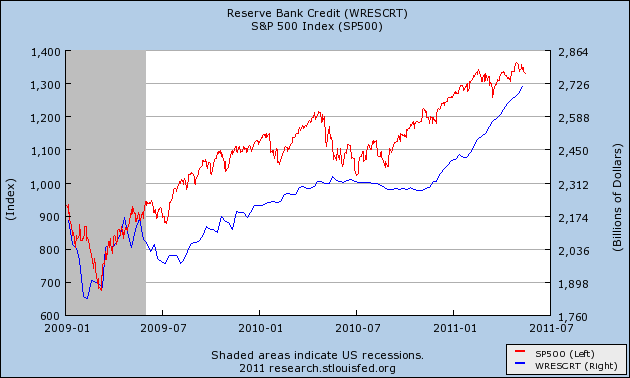

You’ve probably seen this chart going around in recent months. It shows the size of the Fed’s balance sheet and the S&P 500. At first glance, they look perfectly correlated. In fact, the correlation is almost unbelievable:

Of course, there’s more to the story than just that. Since 2009 the economy really has improved. The fiscal stimulus really did work. The calls for doom and gloom in March 2009 were excessive. QE1 really did work to help make a market in illiquid markets. Earnings really have rebounded. That’s not to say that the “recovery” has been strong or even that it’s been organic. No, as is the case in a balance sheet recession, the patient is largely on government life support. After all, it’s the only entity that can provide the support. Had they not stepped in when they did the economy would be far worse and would likely resemble something along the lines of Greece or Ireland where austerity has its death grip on their economies. We can quibble over the various programs and bailouts (many of which I did not support), but that’s for another day….

The correlation between the Fed’s balance sheet and the equity market must be put in perspective. Particularly with regards to QE1. QE1 essentially helped establish a market in illiquid markets. Make no mistake – it was an asset swap just like QE2. I stated this clearly in 2008:

“What Ben Bernanke and Hank Paulson are essentially proposing is an asset swap. The Fed will take on the toxic assets of the banks and they will receive reserves in exchange. This is important because it will alleviate the strains in the credit markets. That’s a good first step, however, it is not a solution to the problem at the household level and THAT is where the real economic weakness is. By introducing this asset swap idea Ben Bernanke is simply altering bank balance sheets. He is not fixing the economy.”

QE1 was effective because it came at a time when markets were highly unstable. And the channel through which it worked was largely psychological. All the Fed did was inject some sanity into a fairly insane market environment. But while there was some fundamental impact I think it’s misleading to draw broad conclusions from these Fed operations with regards to future equity price movements. This is most obvious if we just alter the above chart a little bit and provide some perspective.

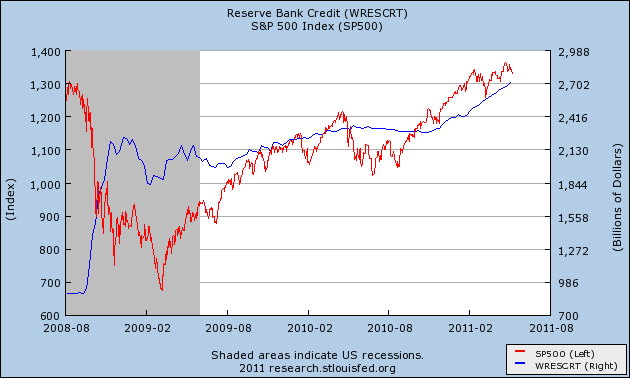

For instance, the chart below was most widely used in 2008 by inflationists. They argued, incorrectly, that that Fed’s injection of reserves would result in inflation and in many cases hyperinflation. Interestingly, however, few of these inflationists were arguing that there would be a correlation between the Fed’s balance sheet and the equity market. As you can see below, the correlation between the Fed’s balance sheet and the equity market becomes dislocated when we back the above chart out to the actual beginning of the Fed’s balance sheet expansion:

For the first 6 months of the Fed’s balance sheet expansion there was actually a negative correlation between stocks and the Fed’s balance sheet. All of the sudden the chart looks like it’s not as useful. Perhaps the correlation between the Fed’s balance sheet and the equity market is not as tight as the first chart above shows. Let’s back the chart out a bit more.

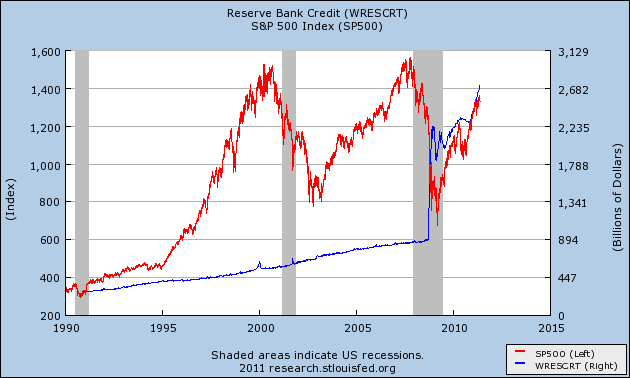

The long-term perspective shows that the correlation totally breaks down. And this is not all that surprising. After all, QE2 isn’t anything unique. It’s just Fed operations at longer duration. In fact, it’s far less impactful on the real economy because of the misguided way in which it’s implemented. Instead of naming a price (as they do at the short end) they are naming a size (see here for more). I think the results of the program pretty much speak for themselves at this point as we now have clear evidence that real GDP topped when QE2 started.

So, is there a correlation between the Fed’s balance sheet and the equity markets? Yes, but it’s difficult to pinpoint. The Bernanke Put and the Greenspan Put have a clear impact on markets, however, it is misleading to manipulate charts to pinpoint this effect. In a normal economic environment (not a balance sheet recession) Fed policy would work by enticing investors to take on more debt. That channel is clearly broken as the private sector continues to de-leverage. So, the only channel through which QE2 can work is through portfolio rebalancing which Ben Bernanke hopes will lead to a wealth effect. Unfortunately, this portfolio rebalancing works almost entirely through psychological channels. Investors don’t have more firepower than they did before QE2. After all, it really is just an asset swap – in this case, 2% paper for 0.25% paper. There isn’t more money sloshing around in the economy and there isn’t more liquidity. There’s just more eager speculators who hope to benefit from the Fed’s form of ponzi finance where they target nominal wealth creation as opposed to real wealth creation.

So yes, the Fed’s implicit backing via the Bernanke Put has had a profound impact on market psychology. It has, in essence, created a backstop for speculators. This has been most obvious in the surge in NYSE margin debt levels. So yes, there is some correlation between QE and the equity markets, however, I think it’s misguided to manipulate dates on a chart just to show that QE will lead to this or that. The fact is, QE2 didn’t do much for the real economy. So, while QE may have had an impact on psychology and a resulting surge in equity markets and margin debt, I don’t think we can say that the Fed’s balance sheet directly correlated to anything. And in fact, if the market loses confidence in the Bernanke Put and realizes that QE2 did nothing of substance, we might actually experience an environment in which the equity market declines and the Fed’s balance sheet remains nice and bloated. But that’s just nominal wealth destruction and has no correlation to the lack of real economic stimulus that QE2 provided. And therein lies the real problem with QE2 – it targets nominal wealth with the hope that nominal wealth will lead to real wealth. Unfortunately, that’s just not how economics works. And as I’ve previously discussed, if this nominal wealth binge leads to market dislocations it can have a highly damaging impact on the real economy and ultimately, real wealth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.