“Panics do not destroy capital – they merely reveal the extent to which it has previously been destroyed by its betrayal in hopelessly unproductive works”

– John Mills, “Credit Cycles and the Origins of Commercial Panics”, 1867

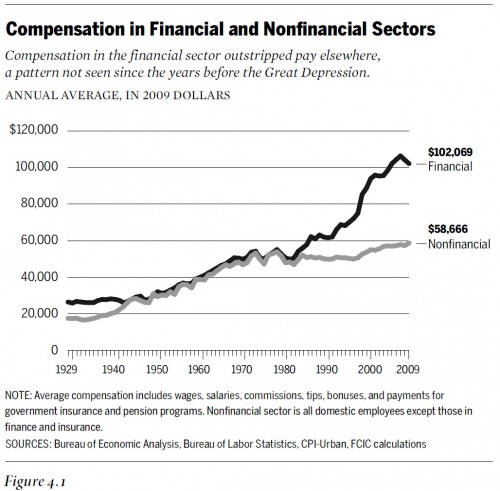

The release of the Financial Crisis Inquiry Commission’s report contained several enlightening nuggets of information regarding the crisis and its causes, however, none was likely more eye opening than the chart showing the growing discrepancy between compensation in financial services and nonfinancial.

Of course, this is all part of the great financialization of our country. It would be easy for me to sit here and villanize the financial industry, but we must also remember that this is a function of the current environment. After all, the government promotes this huge financial industry through lax regulation and consumers have rewarded the financial sector by taking on excessive debt and paying exorbitant fees for their services. To a large extent the American public is to blame for the excess demand they have attributed to this industry.

Many free market proponents will likely argue that the growth in financial services is a function of demand. It is the natural progression of the US economy as it has become a wealthy service based economy. This is a reasonable response. However, that does not mean it is necessarily good. As a society we have to ask ourselves if this financial behemoth is sustainable and in the best interest of the future of America? Are these high rewards disproportionate to their social productivity? Are we becoming a system that diverts excess capital from long-term investment into short-term unproductive casino-like activities?

This is not to entirely undermine the important role that financial services plays in the US economy, however, I think we can likely all agree that the financial sector has and continues to grow wildly out of control while reaping an inordinate amount of the benefits that the US economy generates. We must seriously consider whether this wild growth is not disproportionate and now contributing negatively to our future economic prospects. I believe it is. How could this mass financialization be negative?

- Added risk to the economy through business cycle volatility.

- Talent lost to other more industries which reduces future productivity.

- Monopolist capitalism results in a growing wealth gap and hoarding of capital by a select unproductive sector.

- Economic stagnation thru the misuse of capital.

Unfortunately, there are no easy answers to this problem and the USA is clearly not taking any extreme measures to reverse course. What we need is regulation that helps to ensure that particular entities are not able to detract from the prosperity of the USA. We need to reduce the Fed’s role in markets so as to close the ties between the central bank and the banks it was created to protect. We need to establish fiscal policy which does not exacerbate the gap between the rich and the poor while also rewarding investment. We need to establish programs that help educate the public about financial matters so that the public can become less reliant on Wall Street “professionals”. Clearly, none of this has happened and in fact the USA now appears to be growing back into the same exact animal that existed before the credit crisis. Truly a crisis wasted….

My point here is not to argue that the financial services industry is useless. The financial services industry greases the engine of capitalism. That is an incredibly important function. But we must not become deluded into believing that it IS the engine of capitalism. If it once again grows to become a disproportionately unproductive portion of the economy there is no reason to believe we aren’t at risk of another major crisis. I am always bullish about the long-term prospects for America, however, the financialization of this country is one trend which is not only unsustainable, but could prove as the primary roadblock to future prosperity.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.