There’s a myth in the current economic recovery that just won’t die. It’s this flawed idea that businesses aren’t investing, aren’t hiring and aren’t contributing at all to the recovery. This is not true. In fact, businesses are one of the only reasons this economy hasn’t sunk back into recession already.

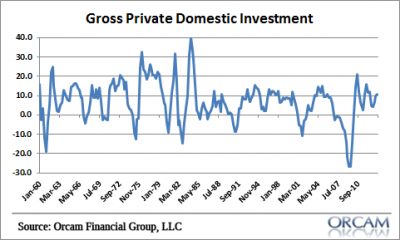

First of all, gross private domestic investment is higher than it’s ever been in nominal terms. It’s true, as a percentage of GDP, private investment is still climbing out of a very deep hole, but it is certainly climbing. And it’s climbing pretty quickly. The year over year rate of change in private investment has averaged 9.3% since 2010. During the 80’s and 90’s, when it’s widely perceived that the business environment was booming, investment averaged just 6.8%.

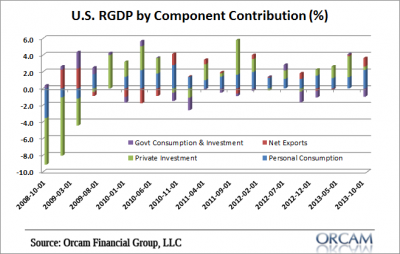

If we look at GDP by contributions private investment has been one of the only bright spots since 2010 (see the green bars):

This has been crucial to understanding the health of the US economy in recent years. I’ve consistently highlighted private investment as a key driver of not only corporate profits, but also GDP growth (see here and here). This was particularly crucial in recent years as the government’s deficit declined. Had we seen a large decline in private investment alongside the deficit then it’s likely that we would have seen much worse economic data. But the reality was that the deficit was declining, in large part, because investment was booming thereby leading to higher tax receipts and not the “fiscal austerity” that many were using as “evidence” of potential future problems in the economy. Lots of people said the sequester and other reductions in the deficit would hurt the recovery. But they’ve been wrong. In large part because they focused too much on the government sector and not enough on private investment.

The bottom line: businesses are contributing to the current recovery. Could they do more? Of course. But businesses are typically reactive to the economic cycle and tend to ramp up investment later in the business cycle as they see demand improving. That’s got its own set of problems to it, but thus far I think it’s safe to say that business investment has been one of the key reasons this weak economy doesn’t look MUCH weaker than it is. And we should all be thankful for that.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.