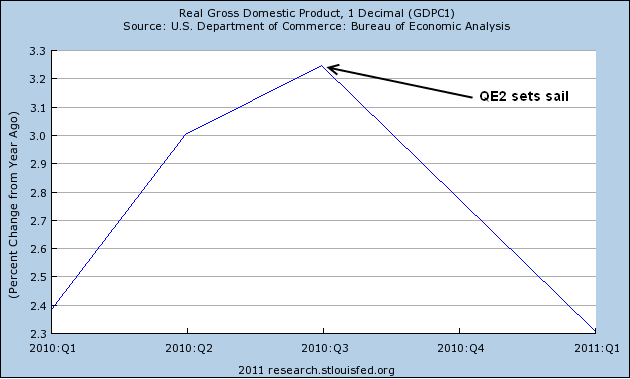

We’re now nearing the end of QE2 and some concrete conclusions can be made. I’ll save my overall analysis of the program until after its conclusion, but I think the impact of QE2 can be pretty much summed up with the following chart:

Economic growth peaked with QE2’s inception

Real GDP peaked as soon as QE2 began. Now, this shouldn’t be shocking to anyone who has been reading pragcap over the duration of this program. From its onset I said QE2 would do nothing for the real economy. In fact, operationally, it could do nothing. But its impacts actually appear to have been damaging to bottom line growth. How so? QE2 helped contribute to a massive surge in speculation in commodity prices.

You see, QE2 didn’t monetize anything. It didn’t cause the money supply to explode. It didn’t really do anything except cause a great deal of confusion and generate an enormous amount of speculation in financial markets that now appears to be contributing to turmoil and strife around the globe. Operationally, it is no different than what the Fed does at the short end when they implement monetary policy. The important distinction, however, is that this policy was implemented incorrectly. Instead of targeting price they targeted size. And the results in the bond market speak for themselves. Rates have meandered up and down and up and down without a care in the world for the Fed’s $600B purchase program. In other words, the program had no impact on rates.

Aside from targeting rates, the program was intended to generate a portfolio rebalancing effect. I won’t repeat the comments I’ve made in the past or those of Richard Koo, but the portfolio rebalancing effect is essentially a form of putting the cart before the horse. Creating nominal wealth without an accompanying real effect that results in real economic growth is very misguided and the worst form of ponzi finance.

Where we saw a real impact was in commodity prices, general price speculation and the financing pyramid. I believe the BOJ has written the finest piece of research detailing this speculative effect. The pass through effect from commodity prices is a contributing factor in the declining real GDP. Inflation has risen marginally due to commodity price increases and the underlying real economy has remained stagnant. In other words, QE2 caused margin compression without helping spur growth. This helped create the disequilibrium I have often discussed. The result is the current air pocket in the economy.

Critics of this analysis are likely to claim that we don’t know what would have happened to the economy without QE2. This is true of course. What we do know is that the economy was growing at 3.3% at the time QE2 was initiated, ISM surged to 57 just days after the announcement and climbed to 58 as the program was beginning. In other words, we can confirm, definitively that the economy wasn’t collapsing as QE2 was beginning, but weakened as the program progressed.

So, the only question left is – if the evidence appears to point to the fact that QE2 didn’t help the economic recovery then why in the world would anyone even consider QE3?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.