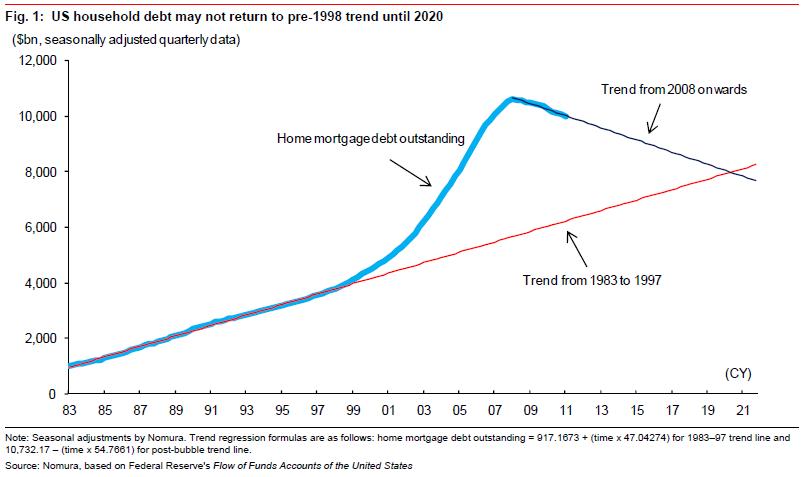

Richard Koo’s latest note contains a chart that regular readers have seen before. Similar to my recent analysis, Koo attempts to forecast the de-leveraging of US households using broader trends (via Business Insider):

It’s easy to look at this chart and conclude that the US economy will remain in the garbage can until 2020 or so. I don’t think that’s an accurate reflection of the current environment though. First of all, Japan is the proper comparison. Greece and the bankrupt Euro nations exist in a monetary system that is not comparable to that of the USA. Although both Europe and the USA are suffering balance sheet recessions, one is an autonomous current issuer. The other is a single currency monetary system in which each nation is a currency user. Therefore, the whole solvency debate in the USA should be disregarded (unlike Greece). Second, we are Japan, but slightly different. As I stated late last year we are Japan on fast forward:

“The bad news is, we are Japan, but the good news is we are Japan on “fast forward”. As I described in mid-2009everything in the USA’s balance sheet recession appears to be occurring much more quickly than it occurred in Japan. So, the good news is that we won’t need government aid as long as the Japanese needed it. In the meantime we must remember that stimulus is not self sustaining recovery. Ultimately, the USA will not be out of the woods until the private sector begins to meaningfully expand, contribute to closing the output gap and help reduce the 9.8% unemployment rate. Based on many macro trends I have said this could be occur as early as 2012, however, any number of exogenous risks could set us back by months or years. Thus far, there are some relatively positive signs coming from the private sector, however, we are still a long ways from sustained private sector recovery.

For now an accommodative Fed, a $1.3T deficit, a general lack of austerity and a tepid private sector recovery is likely enough to sustain economic growth, but not enough to meaningfully close the output gap. This all continues to point to a period of very high unemployment, tepid economic growth and a recovery that feels like a recession. As I said in early 2010 we might be in a technical recovery, but it still very much feels like a recession with a 9.8% unemployment rate. The good news is we’re not talking ourselves off the edge of the cliff. The bad news is the recovery remains tepid and highly susceptible to exogenous risks.”

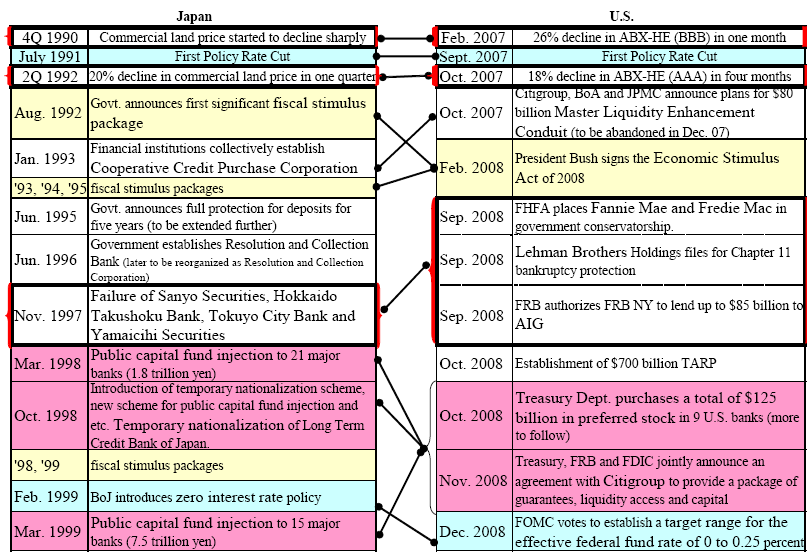

In June 2009 I posted this chart (via Nomura) comparing the Japanese and US credit crises. You’ll notice that it took Japan 10 years to accomplish what the USA did in about 2 years:

This is important because the US government and private sector have been much faster to respond to the balance sheet recession than the Japanese were. Most importantly, we’ve run large and continual budget deficits throughout the current malaise. The Japanese were notorious for their start and stop stimulus which created a bumpy de-leveraging process. The USA has not succumbed to the persistent fear mongering campaigns of those trying to convince us that we are Greece.

As I mentioned the other day, I think a private sector recovery can become self sustaining in 2013 or so given the current trends in incomes and debt levels. Unfortunately, the overall de-leveraging should continue until we see some sort of mean reversion that Richard Koo highlights. This assumes the current (meager) recovery and government aid continues though. That might be a lot to ask given recent rhetoric out of Washington.

In sum, (if current trends hold and the Fed, Europe or China do not derail the recovery) the overall de-leveraging should continue until we see some sort of mean reversion that Richard Koo highlights. That doesn’t mean the economy is going to be weak until 2020 though. Remember, improvement is improvement. As these trends improve investors will view them positively. More likely, it means the US economy will remain weak, but getting healthier at a slow rate with a private sector that is no longer government dependent after 2013. At that point, cash flows should be sufficient to slow the de-leveraging to the point where some level of private sector re-leveraging actually contributes meaningfully to overall growth (we are seeing some signs of this in various loan data already). And if the recovery surprises to the upside (which could very well happen if the Euro crisis is dealt with by 2013) we could see a pretty decent economy some time beginning in the 2013 range.

So yes, we are Japan. We are destined for slow growth and a generally depressing economic environment in the next few years, but don’t go bury yourself in a bunker somewhere with a bag of rocks you bought at the local pawn shop. The real recovery is coming, the world is not ending and if you plan properly now you might just be prepared to ride the back of the next great period of economic growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.