Yesterday’s post by James Montier did much of the heavy lifting on the corporate profit outlook, but I wanted to add a few details to the future outlook since I run a profit model based on similar thinking. We use the Kalecki profit equation to arrive at an approximation of future profits. I’ll save the mundane accounting details for another day, but the basics are rather simple as Montier outlines:

Profits = Investment – Household Savings – Government Savings – Foreign Savings + Dividends

If you’re really looking for a detail outline here I would highly recommend this piece at the Levy Institute.

What you’ll notice in Montier’s work is that private investment is usually the driver of corporate profits. But these aren’t normal times. The effects of the balance sheet recession are still very much with us and the recovery is proving painfully slow. While private investment is improving it remains well below historical levels of 7.5% of GDP. The good news is that mean reversion is working in our favor and the current level of 4% of GDP is likely to continue climbing. Unfortunately, we’re coming off of very low levels and corporations remain cautious in their approach to the economy.

The key takeaway from the Montier piece is that corporate profits have been largely driven by budget deficits in recent years. This has been the single most important understanding of the balance sheet recession. If you understood that large budget deficits would help offset the de-leveraging process then you had a huge advantage over those who thought we were in for one sustained depression. Unfortunately, the risks are mounting in this regard and corporate profits are at the top of the list.

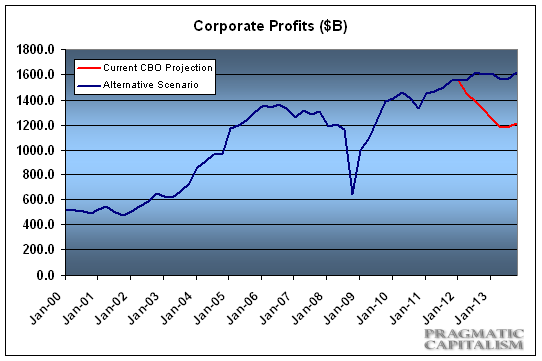

As both Montier and Richard Bernstein have recently noted, the outlook for profits is looking tepid at best. I’ve run two scenarios through my profit model. The first scenario assumes continued mean reversion in private investment, growth in dividends, flat household saving, marginally deteriorating current account and the CBO’s current 2013 deficit outlook. It’s a very reasonable outlook although I’d argue that there is likely upside in the deficit since I believe politicians are likely to continue many of the current policies as the economy remains weak. In the second scenario I’ve assumed more modest cuts in the deficit, a stronger investment boom, flat household saving, flat current account and modest dividend growth. This, in my opinion, is a more likely outcome. The results follow:

(Low to mid single digit profits growth looks to be on the horizon)

The key point here is that without a big debt boom and an enormous and probably historic investment boom the corporate profits picture is likely to come under more pressure as we head into 2013. And if the budget cuts are sharper than expected we can expect a substantial hit to corporate profits. Stay tuned. Budget updates will continue to play heavily into this outlook as the year plays out….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.