There’s been a lot of chatter in recent months about the improving economy and the potential for Fed easing. Some have said it could occur as early as the June FOMC meeting. I think this is likely to be wrong. Here’s why:

1) We’re in the backstretch of the recovery. We’re now into month 47 of the current economic recovery. The average expansion in the post-war period has lasted 63 months. That means we’re probably in the 6th inning of the current expansion so we’re about to pull our starter and make a call to the bullpen. The odds say we’re closer to the beginning of a recession than the beginning of the expansion. That puts the Fed in a really odd position and not likely one where they’re on the verge of tightening any time soon.

2) Unemployment is still way too high. The Fed has been clear that the real tightening will start when they see unemployment at 6.5%. Even the most optimistic projections have us hitting that rate of unemployment some time next summer. That means we’re still a full year away from the Fed’s target. See here for more.

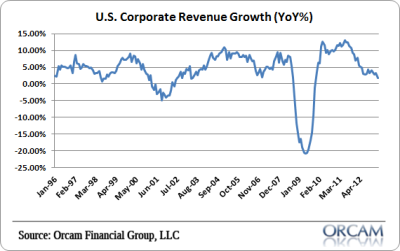

3) Corporate revenues are starting to falter. Companies hire when they’re swamped with demand. And based on corporate revenues demand is at its lowest point since the recovery began. That means the likelihood of hiring picking up steam is extremely low. More likely, corporations will play it safe and try to maintain margins as they offset revenue weakness with cost cutting. If hiring isn’t going to gain momentum then the Fed isn’t easing. It’s that simple.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.