I was surprised at the amount of pushback on my recent piece about T-bonds and my conclusion that rates are low because inflation is low. The piece was cross posted at Business Insider where none of the readers agree with the low inflation conclusion. Here’s a sampling of comments:

One guy said I am a dumb ass who doesn’t go grocery shopping (one of those is actually true!*):

“Just another dumb!@#$ who doesn’t have to go grocery shopping, I guess.

Another cited gas prices:

“When I drive to the gas station, I sure don’t see inflation there either….”

Another guy even said I was smart, but disconnected from the real world:

“The problem with guys like Cullen that they are very smart explaining text book materials but always have the issue to figure out the real world. “

Alright. I mean, I try to take an unbiased perspective of these things. After all, I rely on being right about future market prices in my line of work and not selling some political line so it doesn’t help me one iota to be biased when I look at these things. Luckily, I’ve had the story on rates and inflation right for a long time running, but let’s see if we can explore some “reality” based metrics to make sure I am not totally disconnected from the real world.

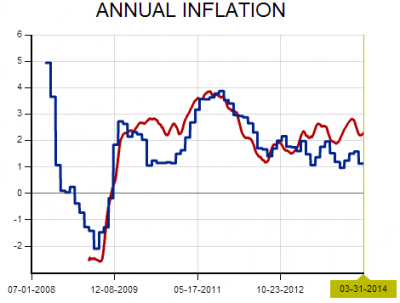

First, let’s look at some independent inflation gauges. The Billion Prices Project confirms the low inflation at just over 2% according to their reading:

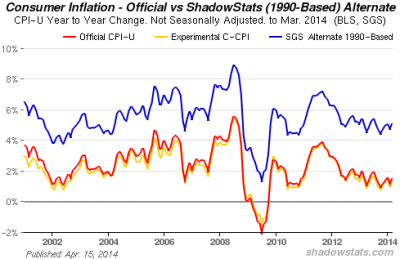

Even Shadow Stats, the undisputed king of the “hyperinflation is coming tomorrow” theme says the rate of inflation is declining or sideways (though obviously higher than the CPI):

So clearly, inflation isn’t taking off even if we use independent gauges. But what about food and gas prices? Obviously, it’s not representative of reality to strip these measures out since we all pay a healthy portion of our monthly bills towards these items (though the Fed strips them out to reduce noise because they are quite volatile measures). So let’s take a look there.

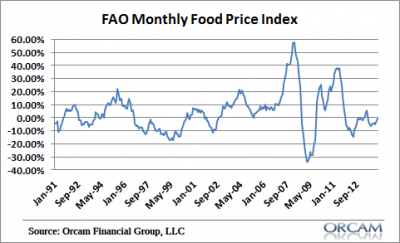

Here’s food prices according to the FAO showing a year over year DECREASE in prices of -0.95%:

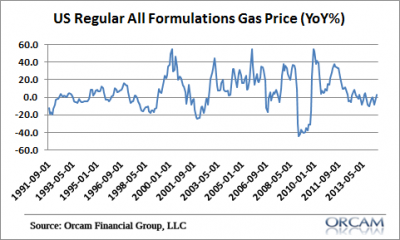

What about gas prices? According to the latest monthly data we’ve actually seen deflationary trends for the entirety of the last 12 months and the latest year over year reading of +2.5% is hardly worth getting too worked up over:

So this is clearly not a food and gas issue. In fact, the low inflation seems to be across the board at present.

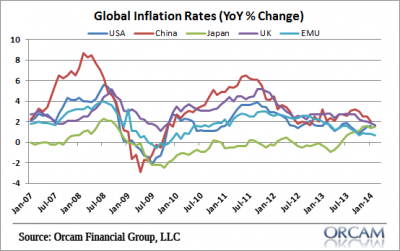

Lastly, this isn’t a US problem. Low rates of inflation are seen all over the globe in all the major economies at present. If this is a conspiracy theory then to mask the reality of higher prices then it’s an incredibly well coordinated one achieved by all global governments and just about everyone reporting price data. I personally find that very hard to believe….

* I do go grocery shopping.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.