Noah Smith has an interesting post on Bloomberg about the potential that there’s really no such thing as the business cycle. But I have a few problems with this idea:

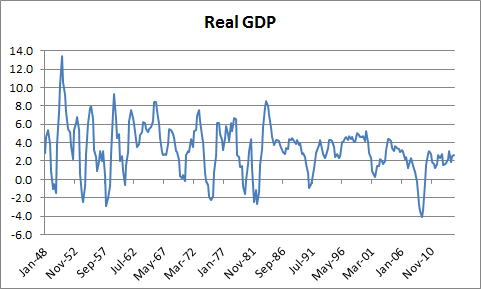

1. First, the chart Noah uses in the post is a bit misleading. We judge GDP growth by its annual change. And when we look at the annual changes in GDP it become obvious that there is cyclicality:

2. As I’ve discussed previously, business cycles are getting longer for very obvious reasons, but that doesn’t mean they’re going away. In fact, one might conclude, following the recent crisis, that the cycles are starting to get longer and more volatile. So yes, it’s not a “cycle” in the sense that it exhibits regularity across time, but there are obvious booms and busts as time passes. Still, long-term growth in GDP should not be confused with the lack of cyclicality.

3. Implying that there is no such thing as a business cycle assumes that the financial system is a linear system. This is the sort of thinking that leads to Rational Expectations and the efficient Market Hypothesis. This is convenient for economic thinking because it allows an economist to remove all the outliers and fat tails from their models and shrug off what can often be the most important events in our economic history (like the financial crisis). Linear modeling of the economy assumes that there are no major mistakes by “the market”. In fact, conservative economists generally prefer this type of modeling because it means that “the market” can’t be shown to be imperfect or in need of outside intervention. A linear system is an efficient system whereas a dynamic system could be shown to be an imperfect market process.

Assuming away the business cycle is a dangerous path to take because policy makers won’t see these events as a failure of “the market”, but as something anomalous that can’t actually be fixed. In essence, it leads economists to conclude that cycles are self correcting back to trend as long as we let “the market” do what “the market” does best. But when one understands that the booms and the busts of the system are often the result of our own imperfect thinking and our own imperfect system then it becomes clear that there is a very real rationale for discretionary intervention at times.

The business cycle is a very real thing that results from the imperfect and irrational decisions of the market’s imperfect participants. We are emotional, biased and imperfect creatures. Which is fine. But assuming that away is not going to help us avoid the next big crisis. In fact, misunderstanding this reality is one of the big reasons why the crisis happened in the first place.

Update – There’s some confusion about my thinking here because I am not using the mainstream linear modeling approach of the economy where there is some assumption of a trend growth. In most Monetarist and New Keynesian models the economy is assumed to grow at some “natural” linear rate and it deviates from this trend only temporarily for various reasons (supply, demand shocks). I am not only saying that there is cyclicality within a linear natural rate environment. I am ALSO saying there is cyclicaity in a non-linear growth rate environment. Saying that the long-term trend in growth can be shifted or knocked off line permanently due to shocks to the economy does not mean there is no cyclicality inside of these environments. It just means that the cyclicality is dynamic.

Update 2 – It looks like the confusion is my fault. By using the term “cycle” I’ve implied that we’re in a naturally mean reverting system. That’s not really what I intended to imply. Instead, I meant to imply that the financial system has deterministic causes and effects that lead to specific outcomes. These outcomes can look like “cycles”, but are probably better described as “fluctuations” in a multiple equilibrium environment. There’s also no necessary relationship between linear systems and some of my conclusions in point 3. Sorry for the confusion.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.