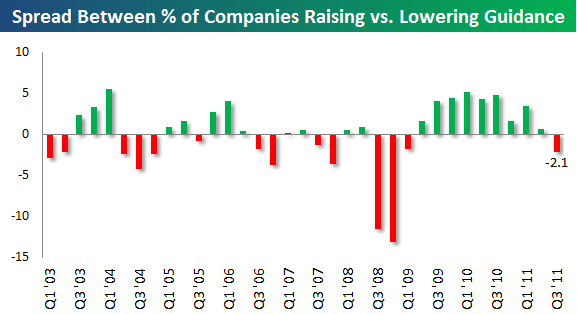

Prior to this most recent earnings season I noted a disconcerting trend in my Expectation Ratio – the likelihood that future guidance would begin to decline for the first time since 2009. And with the earnings season now in the books we can see that this is very much the case. As Bespoke Investments noted yesterday, this quarter was the first quarter of declining guidance since Q1 2009:

“Earnings season came to an end last week, and probably the most notable takeaway from the reporting period was how poor guidance was. Just under 9% of US companies lowered guidance from October 11th through last Tuesday, while 6.8% of companies raised guidance. This works out to a spread of -2.1 percentage points when subtracting the percentage that lowered guidance from the percentage that raised guidance.

Below is a chart showing the quarterly guidance spread going back to 2003. As shown, this is the first time since the bull market began in March 2009 that more stocks have lowered guidance than raised.”

This is the first real sign that the powerful earnings trend of recent years is beginning to show some signs of deterioration. Now, this is no reason to overreact as earnings in the quarter were still very solid, but I think this generally confirms the weak economic outlook and high level of risk currently in the global economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.