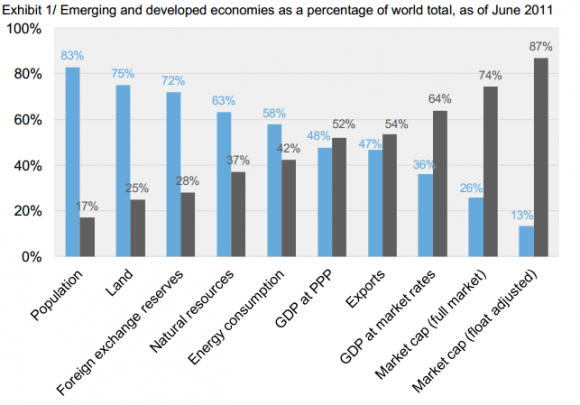

Excellent piece here by Michael Batnick on foreign bonds. Michael and I both agreed that John Bogle was wrong to say that an investor should shun foreign stocks, but what about foreign bonds? There’s a lot to like about foreign bonds. Russell Investments laid out a good case here. For instance, if you look at most of the major developing trends in the world emerging markets look like a must own portion of the world:

Remember, the USA was once an emerging market and shunning emerging markets now is the same as looking at the USA in 1850 or 1900 and saying that it’s not developed enough. Of course, that’s not the point of investing. When you’re investing for growth and protection of your purchasing power you want to skate to where the growth is going to be, not where it’s been. John Bogle likes to demean forecasters, but I’d argue that he is just suffering from recency bias which leads to his home bias. In fact, his insistence on non-forecasting is what leads to his incorrect conclusion about foreign stocks.

Anyhow, I wanted to elaborate on Michael’s point because I think there’s some sound thinking to support his conclusion (and mine). The main reason you add bonds to a portfolio is because you want to diversify the risk of owning stocks. The way I usually describe this is by using a simple example. If Apple Corp raised funds by selling $100 in 5% 10 year bonds and $100 in stock which would you want to own? Would you prefer just $100 of stock or $100 of bonds? Well, it depends of course, but the instruments are both functions of profits. That is, if Apple goes bankrupt both instruments will be worthless (though stockholders are subordinate and will certainly be wiped out). So, if you wanted to take a lot of risk you’d just buy the stock which might generate a better return, but will likely have a higher degree of risk. If, on the other hand, you wanted to create a more steady return you might blend your holdings. The bond steadies the portfolio return because it has embedded guarantees. You know, as long as Apple stays solvent, that you will get your principal plus 5% annual interest back after 10 years. Who knows what the stock will be worth in 10 years though? The point is, you own bonds because they stabilize a portfolio.

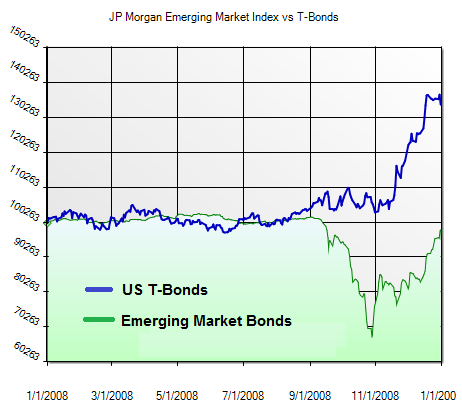

That brings us to government bonds. The reason you own government bonds is also for stability. But not all government bonds are stable. In fact, some can be quite unstable. If we look at the performance of emerging market bonds during the financial crisis they added little stability to a portfolio:

This makes sense. If you own bonds for protection against permanent loss risk then you want to own the highest quality bonds. Now, this doesn’t mean you have to own US government bonds. But I would argue that you want to own high quality developed market bonds of some sort. The reason why is simple – if you want to diversify your portfolio so you have exposure to the growth in emerging markets then use an instrument that actually takes advantage of that growth by owning stocks. But owning emerging market bonds just doesn’t complement this slice of stocks with the stabilizing component that many should expect from fixed income. And that means that in order to help stabilize that growth component of your portfolio you likely need to diversify into high quality developed market bonds of some sort because emerging market bonds and many other foreign bonds just won’t provide the stability when you most need it.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.