Well, it turns out that Jack Bogle is an advocate of active investing. Yes, the myth of the passive investor appears to be dying fast. In a recent Bloomberg article the king of so-called “passive indexing” advocates an active home bias and says that investors shouldn’t even consider investing abroad. He says:

“I like the U.S. The U.S. is the most productive country in the world. It is the most rapidly growing of the industrialized nations, other than Switzerland. We still have plenty of problems, but we’re much better than France, Britain and Germany. And we don’t even want to talk about Italy and Greece. And importantly — people forget this too quickly — we have the most established government and legal institutions.

When you look at global market capitalization it’s true that the U.S. accounts for about 48 percent and other countries 52 percent. But the top three markets outside the U.S. are the U.K., Japan and France. What’s the excitement about there? Emerging markets have great potential, but have fragile sovereigns and fragile institutions.

I wouldn’t invest outside the U.S. If someone wants to invest 20 percent or less of their portfolio outside the U.S., that’s fine. I wouldn’t do it, but if you want to, that’s fine.”

That’s pretty interesting stuff. Bogle is obviously making a pretty active decision here by choosing only to invest in 50% of the world’s stock markets. He downplays it by claiming that US stocks don’t perform all that differently from international stocks, but that’s only because Bogle conveniently ignores the highest growth regions of the world – emerging markets.

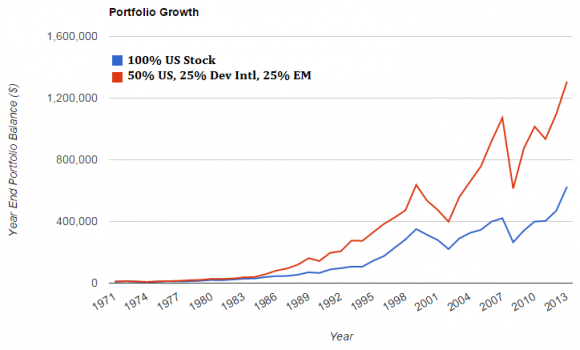

If we look at the last 40 years since emerging markets started to become substantial components of the Global Financial Asset Portfolio it becomes clear that Bogle is wrong and not by a small margin. A portfolio that was 50% US stocks, 25% developed international and 25% emerging markets generated an annual return of 14% over this period with a standard deviation of 19.8. A pure US portfolio generated a 12% return with a standard deviation of 17.9. You not only generated a better nominal return by adding emerging markets, but you improved your risk adjusted returns as well. Over this 40 year period the equity portfolio with a 25% slice of emerging markets more than doubles the total portfolio balance of the pure US portfolio.

More importantly, I would argue that Bogle is viewing the financial asset world through the rear view mirror. The highest future growth is unlikely to come from developed countries. In fact, the points that Bogle makes about how established the US economy is, are the precise reasons why it will likely generate lower returns than the emerging world. As the emerging world takes market share from developed countries their institutions and companies will also change. The USA was once an emerging market before Americans began assuming that it was the only game in town. And here we now sit as the most developed global market very likely to lose global market share to surging populations and middle classes in countries like India, China and other emerging markets.

I think Bogle is dead wrong here. Not only is he contradicting his own “passive” view on asset allocation, but he’s using an approach that assumes that the USA will be the dominant market just because the recent past has told us so. This thinking, I fear, is the result of this sort of “passive” indexing mentality. Not only do they often fail to realize that they’re explicit asset pickers with biased allocation selection, but in failing to utilize a forward looking model they end up assuming that the past is prologue when it very likely isn’t.*

* As Cliff Asness rightly notes, you can’t deviate from global cap weighting and then disparage active investors since this choice to deviate from “the global market portfolio” is, by definition, an active asset allocation decision.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.