There has been a pretty substantial amount of good news over the last few years. In fact, I’ve argued that this recovery doesn’t get as much credit as it deserves. But we have to maintain some perspective in these discussions and remember just how deep the hole we’re coming out of really was.

It’s tempting to compare the current recovery to past recoveries. And in doing so we are inclined to assume that we might approach a policy response with similar concerns and actions. But this economic environment is nothing like the recoveries over the last 30 or 40 years. And we need to look back at those recoveries to see just how unusual this environment really is.

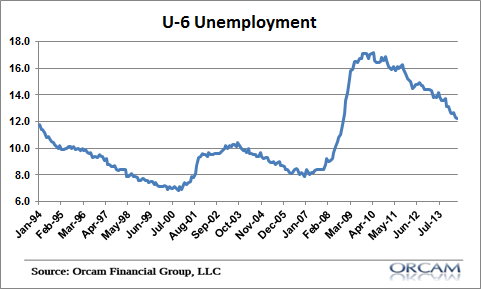

To see just how deep the hole was we need look no further than the state of the US workforce. And the devastation there was tremendous. For instance, the U-6 unemployment rate is still above any point during the last 20 years:

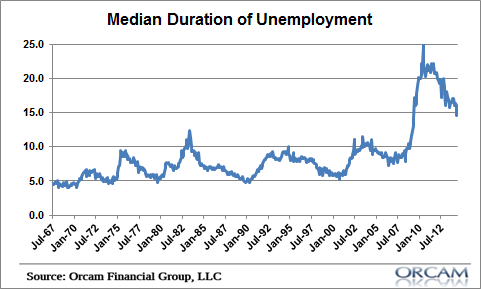

And the median duration of unemployment is still substantially higher than it was during the last 45 years:

These are numbers that signify a devastating situation in the US labor market and NOT one where we should be overly concerned about an economic boom. Although there have been many positive economic signs in recent years I think it’s a mistake for policy makers to jump the gun tightening policy too quickly. The inflation boogeyman isn’t going to resemble anything like we’re used to. In fact, if the past is any guide then the state of the labor market means that inflation is unlikely to surge any time soon.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.