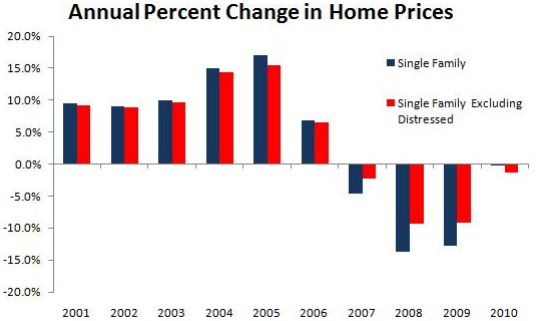

The latest housing data from Corelogic showed continued declines in US residential real estate. According to their most recent data the national average price for single family homes fell by 5.46% compared to December 2009.

“CoreLogic (NYSE: CLGX), a leading provider of information, analytics and business services, today released its December Home Price Index (HPI) which shows that home prices in the U.S. declined for the fifth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.46 percent in December 2010 compared to December 2009 and declined by 4.39 percent* in November 2010 compared to November 2009. Excluding distressed sales, year-over-year prices declined by 2.31 percent in December 2010 compared to December 2009 and declined by 2.81* in November 2010 compared to November 2009. Distressed sales include short sales and real estate owned (REO) transactions.

Annual data for 2010 shows home prices stabilized with the average annual HPI index showing no change relative to 2009. That compares to a 12.7 percent decline between 2008 and 2009. The stabilization in annual prices follows double-digit declines in 2008 and 2009 and is a sign that the largest declines are over. According to Mark Fleming, chief economist with CoreLogic, 2010 was a year of ups and downs as a result of the improvements brought on by the tax credits followed by the declines that occurred when they expired. “It was a bumpy ride which ended with a net gain/loss of zero. Despite the continued monthly decline in home prices and year-over-year depreciation, we’re encouraged that on an annual basis we’re unchanged relative to a year ago. Excess supply continues to drive prices downward, but the silver lining is that the rate of decline is decelerating,” he said.”

Clear Capital’s more recent January report showed some signs of stabilization. The housing double dip appears to be in progress, however, signals are mixed as to how deep the dip will be.

Source: Corelogic

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.