Gauging from the market reaction to the end of the EU summit, you might presume that the European sovereign debt crisis is over. But this is clearly not the case as the EU summit really didn’t alter anything.

Let’s remember, the cause of the sovereign debt crisis is rather simple. These countries are all using the same currency so there is no floating exchange rate to help balance trade. This leads to persistent trade imbalances. There is also no federal government. So what happens over time is that trade deficits are built up in certain regions and largely financed trade surplus nations. There is no currency sovereignty in the region because there is no direct linkage between the ECB and the governments. In other words, the ECB serves as a sort of foreign central bank making the governments users of foreign denominated debt. This results in all the countries being currency users which creates a real solvency risk (unlike in the USA). The situation is precisely the same in the US for the states. There are trade deficit and surplus states in the USA and there is a very real solvency risk at the state level. Although all the states use the same currency, the difference is that the states in the USA are part of a union with political and fiscal cohesion. The US federal government makes large disbursements to the states on an annual basis helping them fill any budget gaps that might appear over time. Europe does not have this fiscal transfer mechanism. So, no FX to balance trade. And no fiscal transfer system to eliminate the solvency crisis as it inevitably appears over time as trade imbalances grow.

So, the real fix to the EMU is rather simple. You have to create sovereign monetary states. This means reverting back to the old system or going full bore into a US of Europe. Yesterday’s press conference with Mario Draghi was helpful in understanding all of this. He made it clear that the linkage between central bank and governments would remain broken:

“We don’t want to circumvent the aticle 123 which prohibits monetary financing to governments”

“We have a treaty which says no monetary financing to governments.”

“There should be this respect of the treaty always in our minds”

That is, the ECB is not going to become the fiscal transfer system that is needed. We also know there will be no e-bonds and no fiscal union. The fiscal compact focuses almost primarily on austerity. But we all know by now that austerity in a balance sheet recession only leads to further economic contraction.

So, no fiscal transfer system. And we also know break-up is increasingly unlikely. Draghi responded directly to a question on this:

“It seems quite far-fetched”

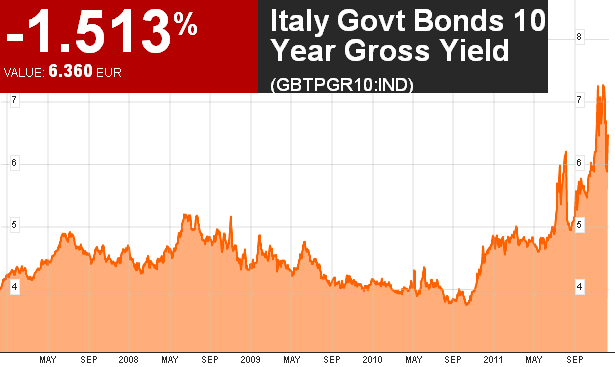

The problem is clear. We’re moving towards a more unified Europe, but the environment is becoming increasingly unstable as unity is increased at a snail’s pace and leaders refuse to admit what needs to be done. Meanwhile, the problems on the periphery are growing worse. Italy, for instance, is not going to grow their way out of their debt trap. The burden is simply too onerous and their growth prospects are meager at best (see here for more). Markets are far from relieved by recent developments as Italian yields, at 6.4% remain uncomfortably high:

I don’t know if we’re going to get a little holiday respite from this EMU crisis, but as I’ve previously noted, the refinancing burden in Italy is very high in the first 4 months of next year. This will almost certainly put pressure on yields and force the EMU into greater action as the crisis flares up again next year at the latest. No, Europe has not been saved and that can they’re kicking is getting much heavier….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.