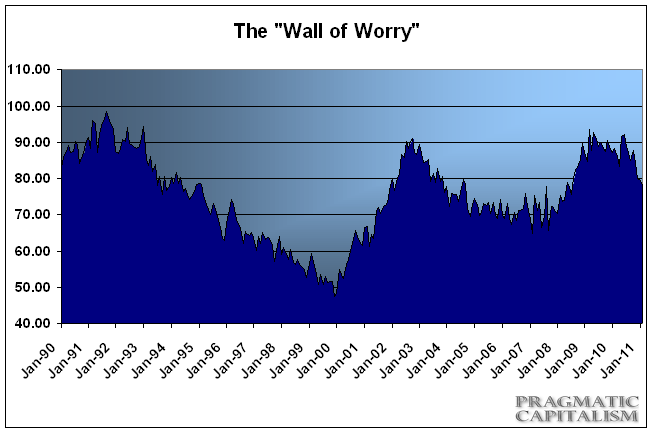

As short-term sentiment levels soar to euphoric levels, longer-term levels of sentiment remain relatively subdued. The Wall of Worry indicator continued its downward trend in March as the index dipped from 77.93 to 74.4. This metric compiles the inverse summation of several sentiment indicators to attempt to track long-term sentiment readings.

The current reading is still high based on historical levels. The index peaked in March of 2009 at 93.5 and is now consistent with readings last seen in 2004 (at the onset of the bull market) and July of 1993 (also early in the bull market). Based on these readings it’s safe to say that a healthy dose of skepticism remains in the market and the “wall of worry” remains high.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.