Still no signs of inflation here. The latest reading from the BLS is showing continued signs of low inflation at both the headline and core level. The headline dropped to 2.3% from 2.6% while the core stayed at 2.3%. The headline figure is still being depressed by the big energy spike last year at this time. While energy dragged on the headline rate again this month, the effect from energy will be significantly reduced in the coming months. This is why I expect there to be little downside in the headline figure as we head into the summer months (barring a big decline in global economic growth, most likely due to China or Europe’s woes worsening).

Not surprisingly, the headline has reverted to the core as it tends to do. Despite all the mainstream media commentary about headline prices, these more volatile components have proven “transitory” as Dr. Bernanke predicted so long ago. Still, the core rate of 2.3% is above the Fed’s target of 2% and likely to keep the Fed at bay regarding further QE.

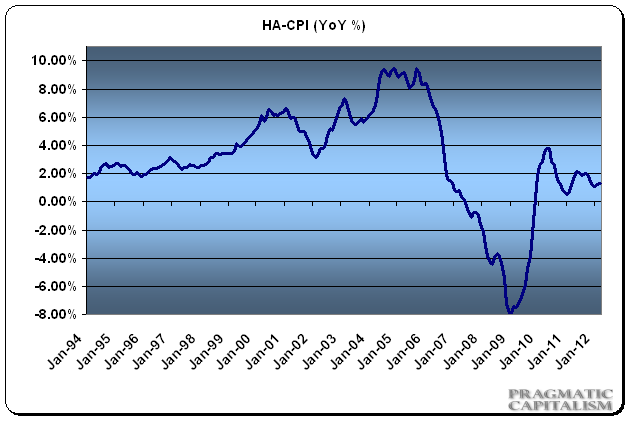

My housing adjusted CPI ticked down to a 1.1% year over year reading. Clearly, when adjusted for the depressed housing market, inflation is much weaker than the headlines say. This index has tended to be more volatile than the BLS figures over the last 20 years so it’s not surprising to see the figure we have today. Nonetheless, all of this is consistent with other independent readings on inflation which point to low inflation. So, the bottom line is, inflation is low and unlikely to spike higher any time soon even though I still believe we’re likely to see the CPI data trend higher as the year moves on. “Higher” is a relative term though. Remember, the CPI has averaged about 3% over the last 50 years so a move from 2.3% towards 3% is hardly something to get worked up over….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.