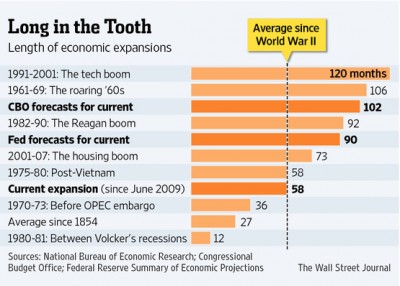

This was a useful chart from the WSJ over the weekend. It puts the current economic expansion in perspective:

We’re in month 58 of the current expansion, which is right in-line with the post-war average. I’ve said that the current expansion is a little long in the tooth, but that it’s important to keep that in the right expansion. While we’re probably closer to the next recession than we are to the beginning of the recovery, it’s also important to remember that the business cycle seems to be getting longer and longer. As I noted earlier this year:

“it’s also interesting to note that the expansion phase of the business cycle appears to be getting longer. You’ll notice that 3 of those 6 long recoveries occurred since 1982. Are these anomalies or are they signs of a changing economic landscape? I think they’re probably signs of a changing economic landscape and that means that a lot of the data that exists before the post-war era probably doesn’t apply.”

So yes, we’re long in the tooth. But that doesn’t mean we can’t get A LOT longer in the tooth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.