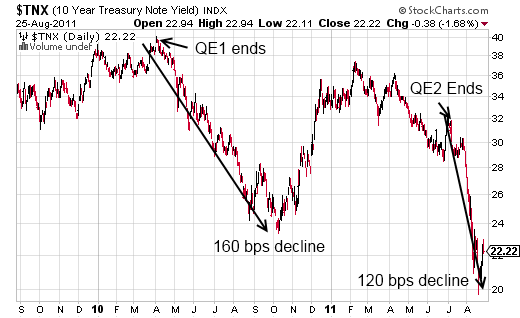

I’ve been incredibly vocal over the last year about QE2 and its likely impact on the US economy and US government bond market. Time and time again I have said that the policy was largely a waste of time and effort and unlikely to have any real substantive effect on the economy (see here and here). The policy was flawed primarily due to one rather simple mistake – it focused on size and not price. This resulted in no real transmission mechanism through which it could impact the economy and failed to control interest rates.

Most investors did not believe this perspective and maintained that QE2 would not only cause surging inflation, but would also cause US government bond yields to surge when the program ended. This was primarily due to the many myths that have persisted surrounding QE2. These were the myths of “debt monetization“, “money printing” and “stimulus”. These are nothing more than common misunderstandings, but investors who listened to these myths failed to assess how QE2 would impact the asset it targeted – US government bonds. None of these misinterpretations was more famous than Bill Gross who incorrectly analyzed QE1, but also misunderstood QE2. Yesterday, the WSJ discussed the investment performance of the PIMCO Total Return Fund as a result of this analysis:

“Bill Gross, long a rock star in the fixed income universe, has been a laggard this year as his bearish view on Treasurys has been confounded by their bull run during the past few months.

Mr. Gross, 67 years old, manages the world’s biggest bond fund–the $245.5 billion Total Return Fund–at Pacific Investment Management Co. The fund has handed investors a return of 2.99% this year through Wednesday, ranking 157th out of 179 funds in the category of intermediate-term bond funds tracked by Lipper.

Over the past three months, the fund just broke even, with a return of negative 0.04%, compared to a return of 2.7% from the benchmark Barclays Capital Aggregate Bond Index, according to data from Morningstar Inc.”

Unfortunately, the WSJ doesn’t appear to connect all of the dots. You see, what PIMCO misunderstood, was not just the impact of QE2, but the actual operational realities of the US monetary system. We’ve tracked PIMCO’s comments in real-time and called them incorrect at several points in the last year. For instance, earlier this year, Bill Gross said June 30th could be “D-Day” when the US government could experience a shortage of buyers in government bonds which would lead to surging yields. Bill Gross asked “Who will buy the bonds?” Mr. Gross misunderstood how QE functions to “finance” the US government (they don’t). And in doing so, he misinterpreted how government bond auctions work. I said these funding fears were unfounded and unlikely to impact bonds. Last year at this time, I vigorously argued that US Treasuries were not in a bubble. And just days before an epic 10% surge in long bonds I said US Treasuries served as part of “the perfect hedge” in this environment. I followed-up to these pieces in greater detail than I cover here (I’ll spare you the repetitious commentary).

The point here is not to say “hey look at me, I was right and Bill Gross was wrong”. The point is that understanding the monetary system matters. Economics is largely “dismal” because the myths of neoclassical economics dominate our classrooms and media commentary. This causes an extraordinary disconnect between the way investors perceive the economy and the markets. And it results in underperformance by fund managers who make mistakes by incorrectly assessing the US monetary system. It doesn’t have to be this way. Hopefully, as time goes on, more and more investors will better understand the monetary system in which we reside. Not only will this avoid investment losses such as the above, but it might actually translate to better public policy. Unfortunately, we’re a long way from that reality….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.