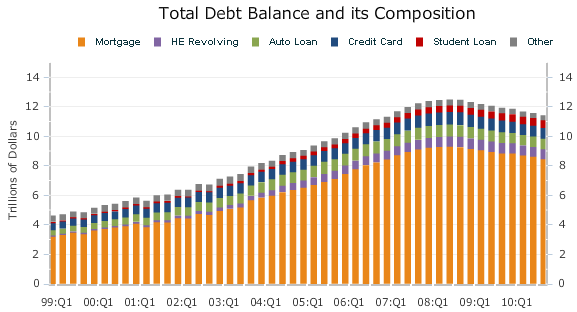

This is a backwards looking report, but the recently initiated quarterly report on household debt and credit has become a nice overview of the debt situation. According to the latest report, de-leveraging continued in Q4:

Aggregate consumer debt continued to decline in the fourth quarter, continuing its trend of the previous two years. As of December 31, 2010, total consumer indebtedness was $11.4 trillion, a reduction of $1.08 trillion (8.6%) from its peak level at the close of 2008Q3, and $155 billion (1.3%) below its September 30, 2010 level. Household mortgage indebtedness has declined 9.1%, and home equity lines of credit (HELOCs) have fallen 6.5% since their respective peaks in 2008Q3 and 2009Q1. For the first time since 2008Q4, consumer indebtedness excluding mortgage and HELOC balances did not fall, but rose slightly ($7.3 billion or 0.3%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.31 trillion, the same level as in2010Q2, 8.4% below its 2008Q4 peak.”

Unfortunately, this report is largely irrelevant as recent consumer credit reports appear to show that the consumer is re-leveraging. That’s likely good in the short-term, however, as I’ve previously discussed, the debt imbalance in the US economy remains and a re-leveraging will only contribute to future economic disequilibrium. This is a good sign for near-term economic growth, but likely a very bad sign in the long-term. These trends are simply unsustainable and without a booming economy in the coming years we could be putting ourselves right back where we were in the run-up to this crisis….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.