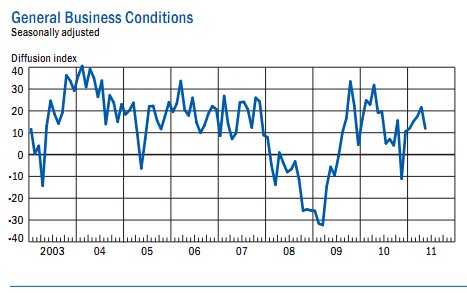

This morning’s Empire State Manufacturing Survey continued to show growth, however, missed expectations by a wide margin. The headline came in at 11.88 versus expectations of 20. Any reading over 0 is indicative of growth so the region is still consistent with a growing economy. The NY Fed provides some details on the report:

“The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in May, but at a slower pace than in April. The general business conditions index fell ten points to 11.9. The new orders index declined fi ve points to 17.2, and the shipments index slipped three points to 25.8. The inventories index climbed to 10.8, its highest level in a year. The prices paid index rose to 69.9, its highest level since mid-2008, while the prices received index held fi rm at 28.0. Future indexes continued to convey a high level of optimism about the six-month outlook, although prices are widely expected to rise.”

This is in-line with the ISM Services data we saw last month. These diffusion indices are coming off of stratospheric levels so while the downturn is alarming it is not cause for panic. Equity markets have tended to correlate highly with the ISM data so it is certainly unwise to brush off this change in trend.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.