I’ve provided quite a few random recessionary indicators in recent weeks (see here and here) so I figured I might return the favor for the bulls out there and offer some random non-recessionary indicators as well. These come courtesy of Mark Perry at Carpe Diem blog:

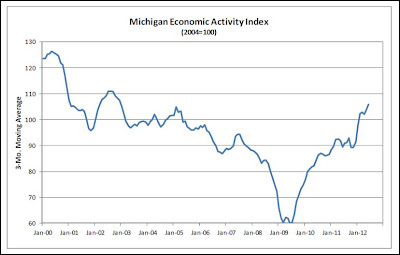

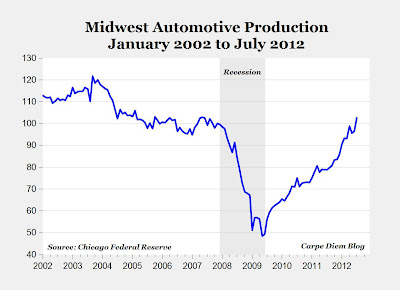

Here’s some extremely positive news about the Michigan economy, which would be consistent with recent reports about the rebound in Midwest manufacturing, and especially strong gains in Midwest automotive production:

Comerica Bank’s Michigan Economic Activity Index (a composite index based on 7 individual variables) increased 2.0 points in June, spiking to a level of 105.9. The June index reading is 46 points, or 77%, above the index cyclical low of 59.9 in mid-2009. The index has averaged 102 points over the first half of 2012, 11 points above the index average for all of 2011.

“The Michigan economy pushed further ahead in June, with our Michigan Economic Activity Index up strongly for the second month,” said Robert Dye, Chief Economist at Comerica Bank. “The rate of job creation has slowed over the first two quarters of the year as U.S. auto sales have plateaued around a 14 million unit annual sales rate in 2012. But outside of durable goods manufacturing, we are seeing ongoing gains. Housing markets statewide are improving as sales and prices increase. New home construction remains low, but is expected to increase to meet pent up demand.”

The Midwest’s automotive output increased by an eye-popping 30% in July from a year ago, compared to a 15.7% gain in national automotive output. The index reading of 102.6 for Midwest auto sector production in July was the highest level since May 2007 more than five years ago, and brings auto industry production in the Midwest to a level above pre-recession levels of auto production from 2005-2007 when the Midwest automotive index averaged 100.1 (see chart).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.