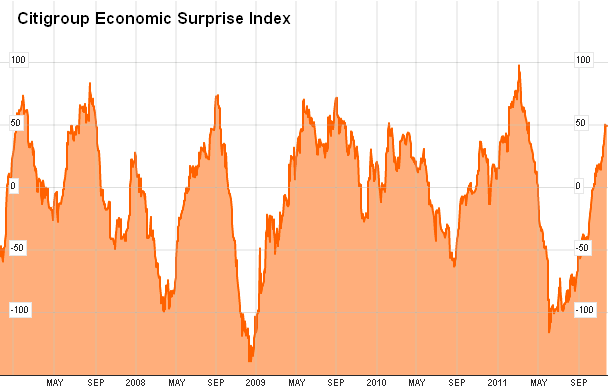

Here’s another hurdle the market doesn’t need right now. Citigroup’s economic surprise index is showing elevated levels. This is consistent with a market environment in which analysts have generally grown excessively optimistic about economic data. The data set is notoriously mean reverting as analysts overestimate and underestimate economic data. Readings at current levels are near the upper end of the historical range so we shouldn’t be shocked if analysts ratchet down expectations or economic data begins to disappoint.

Most alarming is the fact that my Expectation Ratio is showing similar signs of excessive optimism. The combination of the two lead to an environment in which analysts are universally optimistic about earnings AND economic data. That leaves the markets particularly susceptible to downside risks. Just another headwind the markets don’t need at a time when turmoil seems to be the theme day in and day out….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.